The industry saw new folio additions of close to four lakh in equity funds in April.

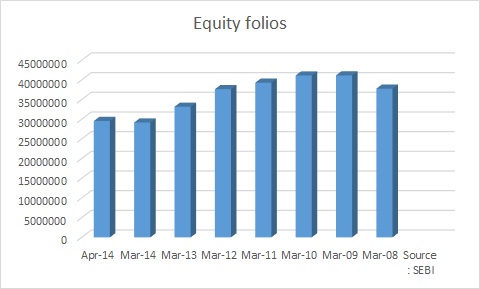

The latest data published by SEBI throws up an intriguing statistic which reveals that folios in equity funds have risen by close to four lakh in April, reversing a four-year trend of continuous drop in folios.

While ELSS category saw a reduction of one lakh folios in April, other equity funds saw addition of 4.89 lakh folios. The number of equity folios stood at 2.91 crore in March which increased to 2.95 crore in April.

As

per AMFI data, the redemptions seems to have come down in the April. Compared

to gross redemptions of Rs. 8,004 crore in March, the redemptions came down to

Rs. 5,219 crore in April which helped equity funds receive net inflows of Rs. 208

crore.

However, the industry is divided on whether the data published by SEBI is correct. “According to my understanding, hardly any new retail investors have invested in equity funds,” said a Mumbai based IFA whose client base consist largely of retail investors.

Fund officials say that it is unlikely that there can be such huge jump in folios considering that only one fund was launched in April. (Motilal Oswal MOSt Focused Multicap 35 Fund was launched in April which collected Rs. 64 crore.)

“Some investors are coming in closed-end funds but there is no net addition in folios,” said Sarath Sarma, Executive Director & Head - Sales, IDBI Mutual Fund.

Some say that it is possible that new folios would have been created in the new as well as existing schemes.

Sunil Subramaniam, Deputy CEO, Sundaram Mutual Fund says “Investors generally leave the folio number option blank while filling up the forms. In such cases new folios are created. In some cases new folios are created even when investors are investing in existing schemes. Also investors have come in closed-end funds. If there is a delay in sending data to SEBI then then folio additions could be reflected in the month of April. It is true that investors are booking profits which was evident by the drop in equity folios in the last six months.”

IDBI Diversified Equity Fund, Birla Sun Life Focused Equity Fund, HDFC RGESS Series II, ICICI Prudential Value Fund Series III, and Sundaram Select Micro Cap Series IV were launched in March which collected Rs. 382 crore.

A recent data published by AMFI showed that HNI folios in equity funds increased by 12 lakh in six months ending March 2014. From 3.40 lakh folios in September 2013, the number of HNI folios increased to 16.29 lakh in March 2014, an increase of 378%. During the same period, retail folios in equity funds have dropped by 32 lakh.

It remains to be seen if there is truly a trend of retail investors coming back to equity funds or its just HNIs pumping in money on the hopes of revival in the economy.