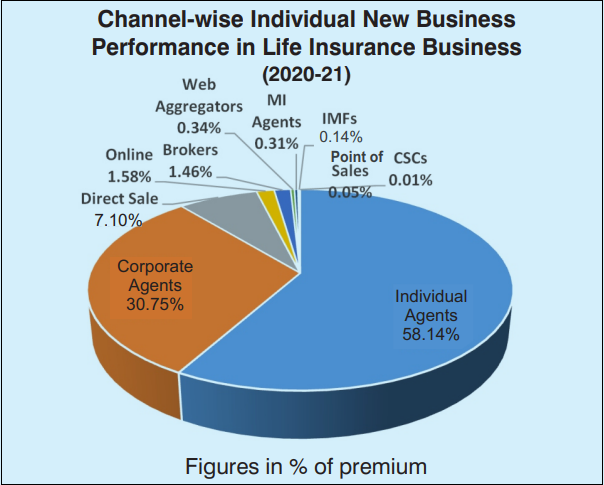

Individual agents have maintained their stronghold in the life insurance business. IRDAI data shows that they brought in 58% of the business for life insurers in 2020-2021. Their contribution in new premium rose from Rs. 3.44 lakh crore to Rs. 3.65 lakh crore.

Corporate agents, which mostly includes banks, were the second-biggest contributors in new sales with 31% share.

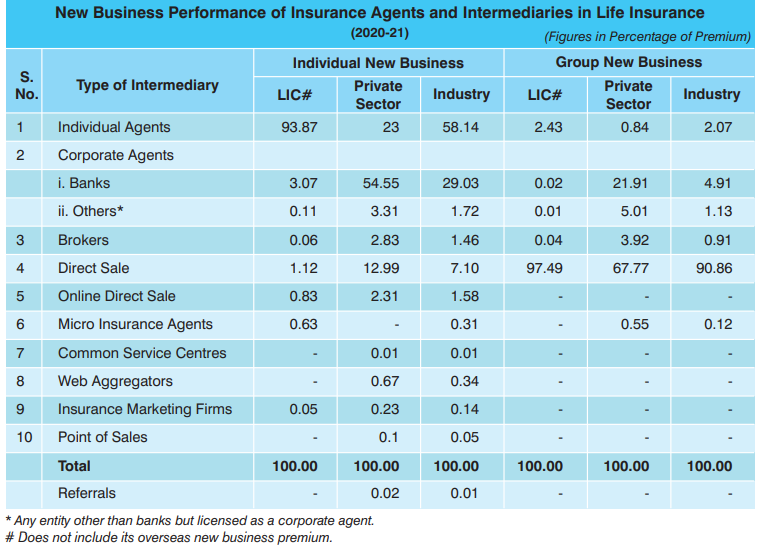

In life insurance business, different distribution channels dominate the sales of different category of players. While the sole public player LIC derives 94% of its new business through individual agents, private companies get the majority of their new business (55%) from banks.

Data from IRDAI's annual report 2020-2021 shows that contribution of individual agents in business of private life insurers is 23%, which is much lower compared to that of LIC.

At the industry level (including both public and private players), individual agents have a share of 58%. Banks are the second-largest contributor at 29%. Direct sales bring 7% of the total new business of life insurers.

While the sales from other channels is negligible in case if LIC, private players get significant business direct sales, brokers and non-bank corporate agents as well.

In case of group life insurance, direct channels dominate the sales for both LIC and private players.