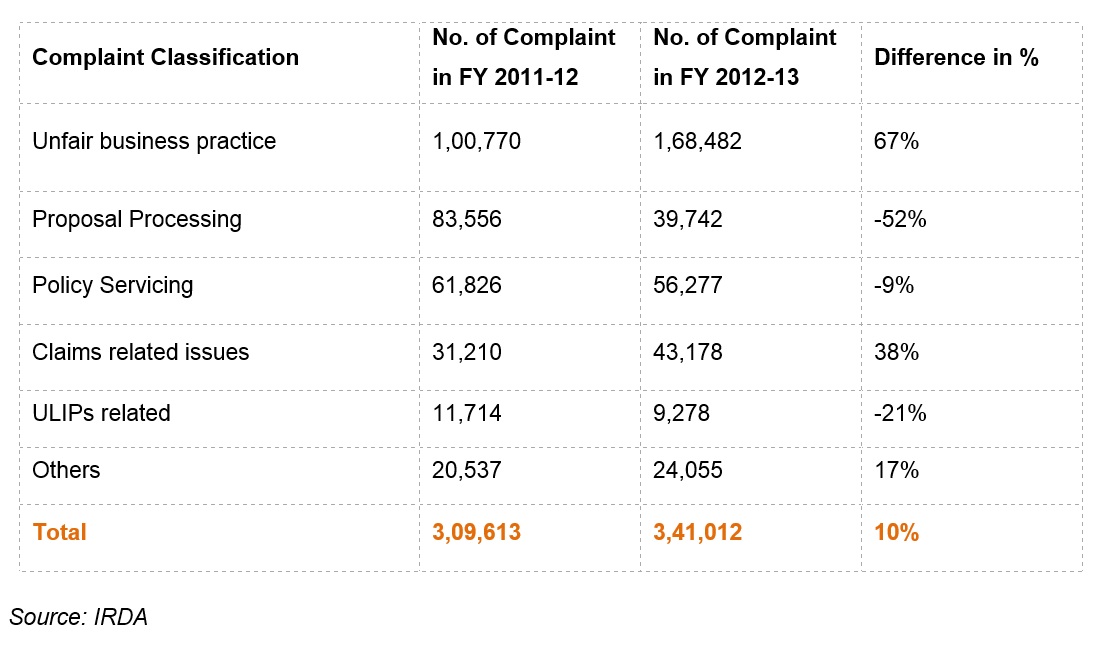

However, complaints for proposal processing and policy servicing declined by 52% and 9% respectively.

Policyholder’s grievances against life insurance companies for unfair business practice increased by as much as 67% or 1.68 lakh complaints in FY 2012-13 compared to 1.01 lakh in FY 2011-12. Experts attributed this to rampant mis-selling by banks under corporate agency model. Also, they pointed out that ambiguous policy documents which go unread by policyholders as another factor for rising complaints.

“Of total complaints related to unfair business practice, maximum number of complaints come from policyholders who were mis-sold by banks. Another major reason is mis-interpretation of policy documents. Many people don’t prefer to go through lengthy policy documents usually written in very small font size,” says an Insurance Ombudsman.

Suresh Sadagopan of Ladder7 Financial Advisories seconds the view and says that many people have surrendered their old policies and bought new policies due to misleading advice of some banks.

IRDA data says the total number of complaints against life insurance companies went up by 10% or 31,000 from 3.09 lakh in FY 2011-12 to 3.41 lakh in FY 2012-13.

State owned LIC, Bajaj Allianz, Birla Sun Life and HDFC Standard received maximum complaints during FY 2012-13.

However, these companies have resolved a large portion of total complaints filed against them. The data shows that LIC has resolved close to 73000 complaints while other insurance companies like HDFC Standard, Bajaj Allainz and Birla Sunlife and Reliance have resolved 50,000, 37.000, 30,000 and 21,000 complaints respectively.

On the other hand, companies like Aviva, Reliance, ICICI Prudential, ING life, Tata AIA recorded lower number of complaints compared to last year with Reliance seeing a major decline of 30,000 complaints.

During FY 2012-13, complaint against life insurers for proposal processing, ULIPs and policy servicing decreased by 52%, 21% and 9 % respectively. “Since new business premium collection and sale of new policies especially ULIPs witnessed a slowdown in FY 2012-13, the number of complaints in policy servicing and ULIPs related issues have declined,” says GN Agarwal, CEO Future Generali Life Insurance.

A senior industry official suggests, “Policy documents of insurance policies should be represented like a 1-2 page executive summary covering only the necessary points like minimum sum assured, policy term, surrender charges etc. This may reduce ambiguity of policyholders about insurance policies and help them to understand it better.”

Ritesh Sheth of Tejas Consultancy believes that new policies formulated under the new product guidelines of IRDA which come into effect from January 01 will reduce the number of complaints since these products are more transparent. However, the insurance regulator should keep a close eye on illustration of products given by the insurance companies, he added.