FM has proposed to increase the limit of deduction on health insurance premium to Rs. 25,000 and Rs. 30,000 for individuals and senior citizens respectively.

Finance Minister Arun Jaitley has proposed to increase the limit of deduction on health insurance premium from Rs.15,000 to Rs.25,000 for individuals and from Rs.20,000 to Rs.30,000 for senior citizens. These limits had remained unchanged for over five years.

The Budget has proposed to allow deduction of expenditure on treatment of very senior citizen (80 and above) of up to Rs. 30,000 who are not eligible to take health insurance. In case of specified diseases, such exemptions can go up to Rs.80,000.

Also, such limits on treatment of differently abled person who are dependent has increased to Rs.75,000. Similarly, the limit has been raised to Rs.1.25 lakh in case of severe disability.

Somesh Chandra, Chief Operations Officer & Chief Quality Officer, Max Bupa said “We are delighted that the budget has fulfilled the wish list of the health insurance sector and delivered on our long standing demand of increasing the tax deduction limit under section 80D. Increasing the tax deduction in health insurance premium will improve affordability, accessibility and awareness of health insurance. Health benefits for senior citizens will facilitate comprehensive health coverage for the elderly and aid tax rebate. The accident insurance for rural and BPL population with annual premium of Rs.12 showcases focus on affordable healthcare provisioning. This will boost health insurance penetration which is currently under 5% and mostly restricted to the urban areas, stimulate industry growth and encourage individuals to raise their health investment.”

In addition, the Budget has proposed to hike limit of deduction on contribution to pension funds i.e. annuity schemes of life insurance companies from Rs.1 lakh to Rs.1.50 lakh.

Similarly, it has proposed to increase the limit of deduction under section 80CCD on contribution to National Pension Scheme (NPS) by Rs.50,000 i.e. from Rs.1lakh to Rs.1.50 lakh. Section 80CCD of the Income Tax Act (just like National Pension Scheme) provides tax benefits over and above the 80C limit which is currently Rs. 1.5 lakh annually. Investors get tax deduction of up to 10% of salary, subject to up to Rs.1.50 lakh on contribution towards pension funds.

Experts believe that the increase in limits for NPS and annuity schemes will not affect the inflows in ELSS and retirement funds. Dinesh Khara, MD & CEO, SBI Mutual Fund said “Mutual funds inflows depend on market performance. Also, these deductions come under separate section of the Income Tax Act. However, mutual fund houses continue to seek government’s approval to launch mutual fund linked retirement plans (MFLRPs), he added.

Meanwhile, the Union Budget has also proposed to provide a facility to file self-declaration for non-deduction of tax on maturity proceeds of life insurance policies. However, the eligibility criteria has not been mentioned in the Budget document.

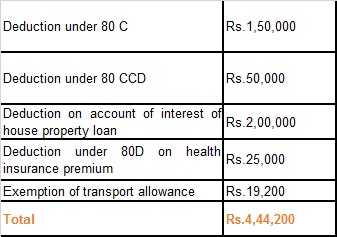

In addition, FM has announced that individual tax payers can benefit up to the extent of Rs.4,44,200.

Here

is the break-up

A rough calculation indicates that individuals can claim tax benefit up to Rs. 6.94 lakh (Rs.2.50 lakh and Rs.4,44,200).