I come from a very poor family in Akola, Maharashtra. My father was a cycle rickshaw driver. We were seven members in our family and my father’s income was never sufficient for all of us. I faced a lot of challenges in my childhood. Sometimes, we did not have enough food to eat. My parents used to quarrel on family issues every day. My entire childhood was spent in poverty with no peace of mind. Our house was too small for the family to stay. I had to walk 10 km to reach my school, sometimes barefooted and sometimes on empty stomach.

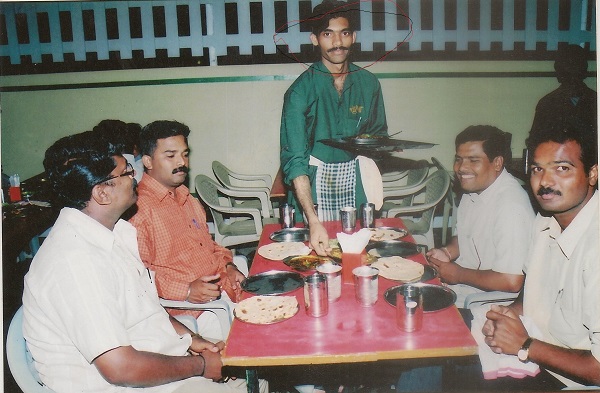

In 1998, immediately after completing secondary education, I left my home at the age of 16 with the hope of getting a job in Nashik. When I arrived there I had to deal with a series of challenges - sleeping on railway platform, going without food for several days and being all alone in an unknown place. My search for a job ended with me becoming a helper in a restaurant. As a helper I used to earn Rs. 20 per day by cleaning the floor and utensils.

But I was relieved that at least I got a place to stay. I became friends with waiters but their company came host of bad habits. I realised this was not taking me anywhere. I changed several jobs that paid me marginally better than the previous one but it was still a waiter’s job. I knew I wanted to be elsewhere - someplace bigger and better!

It happened by chance. I used to work as a waiter in a restaurant in Nasik and in 2004, someone suggested me to sell insurance policies. I saw an opportunity in this and so I started selling insurance policies from morning till evening and worked as a waiter at night.

How were the initial days of your business? What kind of challenges did you face? How did you overcome the same?

I was new to this city. Making contacts was my first priority as people did not trust me easily. My first commission from insurance was Rs.2,100. For the initial three years, I invested my earnings in enhancing my knowledge by buying books and by enrolling for courses. After gaining confidence, I quit my job as a waiter in January 2007 and took up insurance advisory as a full time job. During this time, my bank balance was only Rs.17,000. I wanted to reach out a wider audience. So I spent Rs.12,000 for putting up a stall in an exhibition. I took personal loan and bought an office in 2007.

How did you acquire clients?

I was selling life insurance and my next step was to get the mediclaim agency. To expand further, I took up mutual fund advisory in 2008. I used to put up stalls on the roadside to grab people’s attention. Today, I have around 200 clients including 10 HNI clients. In 2011, I completed my CFP and alongside passed a certification for ‘Capital market dealer’ by NISM.

How much assets under advisory do you manage in mutual funds? How did you manage to get it?

My current AUM is Rs.7 crore in mutual funds. Recently, I got Rs.11 lakh insurance premium from a single family. A HNI client invested Rs.45 lakh in mutual funds and another HNI client started SIP of Rs.70, 000 per month.

What were your biggest learnings as a financial advisor?

I believe education is important to succeed in life. In 2004, I completed my B.Com from an open university. But one should take it in their stride. I always try to inculcate good habits, be with good company and believe in upgrading my knowledge constantly.

Please share a memorable moment in your financial advisory journey.

There are many moments to share. But, when people come and thank you for helping them in managing their finances, I consider this as my biggest achievement.

Apart from mutual funds, what are your other businesses?

I run Varad Training Academy which is a training firm for insurance agents. I’m also into organic farming.

What is your key to success?

I am hardworking and do not easily give up. I have faith in god and this makes me grow stronger. I work for my dreams without any compromise. My advice to aspiring advisors is to be positive, polite and serve people who are in need. Stay humble and stay focussed.

At one time, I did not have a shelter. Today, I own a flat worth Rs. 30 lakh, have a car and own five acres of land.

What are your future plans?

My strongest desire is to possess a total networth of Rs.100 crore within the next two decades.