Much before the popularity of SIP amongst investors, Rajkot IFA Ravi Kalariya used to encourage his clients to invest via the SIP route.

Initial journey

An entrepreneur at heart, Ravi always dreamt of starting his own business. An MBA in Finance and Marketing, Ravi had completed his AMFI and IRDAI certification during his college days to understand mutual funds and insurance distribution business.

However, he decided to spend some years in the corporate sector before starting out on his own. His first stint was in UTI Bank as a Sales Executive in 2004 where he was responsible for sales and client relationship. Later on, he moved to ICICI bank as Area Sales Manager. During this period, his desire to start out on his own strengthened and financial advisory seemed like a natural choice. In March 2006, he started Investment Plus.

Client acquisition

The initial days were quite challenging. His first set of clients were his friends, family members and acquaintances at banks. He followed a simple approach - ask every client he met for referrals. On an average, he meets at least 10 prospective clients daily.

After a few years, referrals came naturally for Ravi. He claims to receive at least three referrals a day. He now manages over 1,050 clients with assets under advisory of over Rs.107 crore in mutual funds.

SIP conviction

Ravi believes that though SIP takes time to bear fruit for distributors, it ensures that distributors get a regular growth in assets under advisory. Also, since the ticket size in SIP is low, it is easy to convince prospective clients to start SIP.

He feels SIP is a win-win for both investors and distributors. Thanks to rupee cost averaging and power of compounding, a long-term investor can benefit from both the upturns and downturns in the market.

Explaining SIP investing through cricket

Ravi adopts a novel approach to encourage his clients to invest for their financial goals. He draws analogies from the game of cricket to help his clients understand goal based investing.

Connecting required corpus to target score in cricket match, he tells his clients that a batsman follows two strategies to win the match. He regularly scores one or two runs to keep the scoreboard moving. Additionally, whenever he gets a right opportunity, he hits a six or a four to give a boost to the score.

Similarly, he encourages his clients to invest small amounts regularly through SIP. These investments are like the one or two runs. They slowly but steadily bring investors closer to their desired corpus. He also shares historical data on SIP performance to demonstrate their ability to generate returns across different markets.

In addition, he motivates his clients to invest lumpsum amounts received occasionally such as bonus or inheritance. He calls these lumpsum investments as the fours and sixes that propel investors closer to their target amount.

Once his clients achieve their goals, they get more confident and approach Ravi to increase their SIP. Sharing one such example, Ravi said, “One of my clients started by investing Rs. 10,000 per month and today has a SIP of Rs. 1 lakh. The growth in markets coupled with clients increasing their SIP commitment has multiplied my SIP book.”

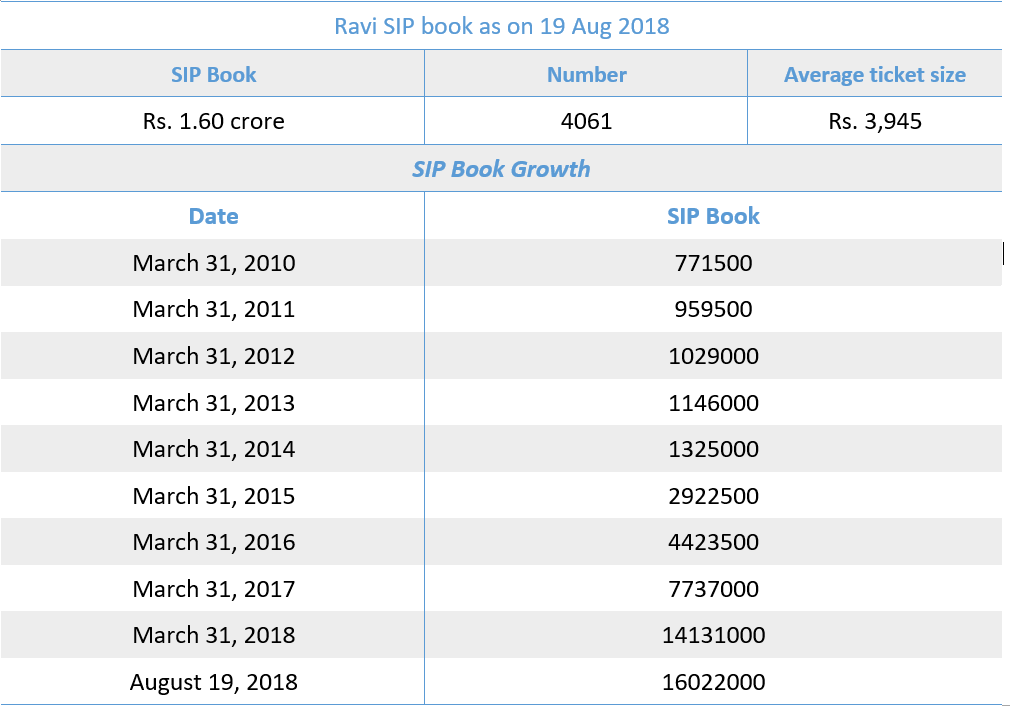

Ravi’s focus on systematic investing from day one has helped him build a formidable SIP book over the year.

Client engagement

Along with client meetings where Ravi talks about their investments, portfolio rebalancing and future goals, the team also connects with their clients on social media. They have a Facebook page, WhatsApp group and YouTube channel through which they regularly share relevant news articles or informational content with their clients. Ravi and his team also regularly ask clients for their feedback to understand areas of improvement.

To provide excellent service, Ravi has a dedicated client’s service desk, which resolves client queries quickly. He personally checks the status of the queries at the end of the day.

Ravi’s journey is an inspiring story of how helping clients fulfil their goals helps you grow your business.