I know most of you find me (debt funds) a bit confusing on a cursory glance.

I know most of you find me (debt funds) a bit confusing on a cursory glance.

Let me introduce myself. I am debt funds version 2.0. Let me first give a little background to help you understand why I need to introduce myself. A few months back, SEBI had asked fund houses to follow the uniform guidelines to structure their schemes with a view to bringing clarity and uniformity among different funds to help investors take informed decisions.

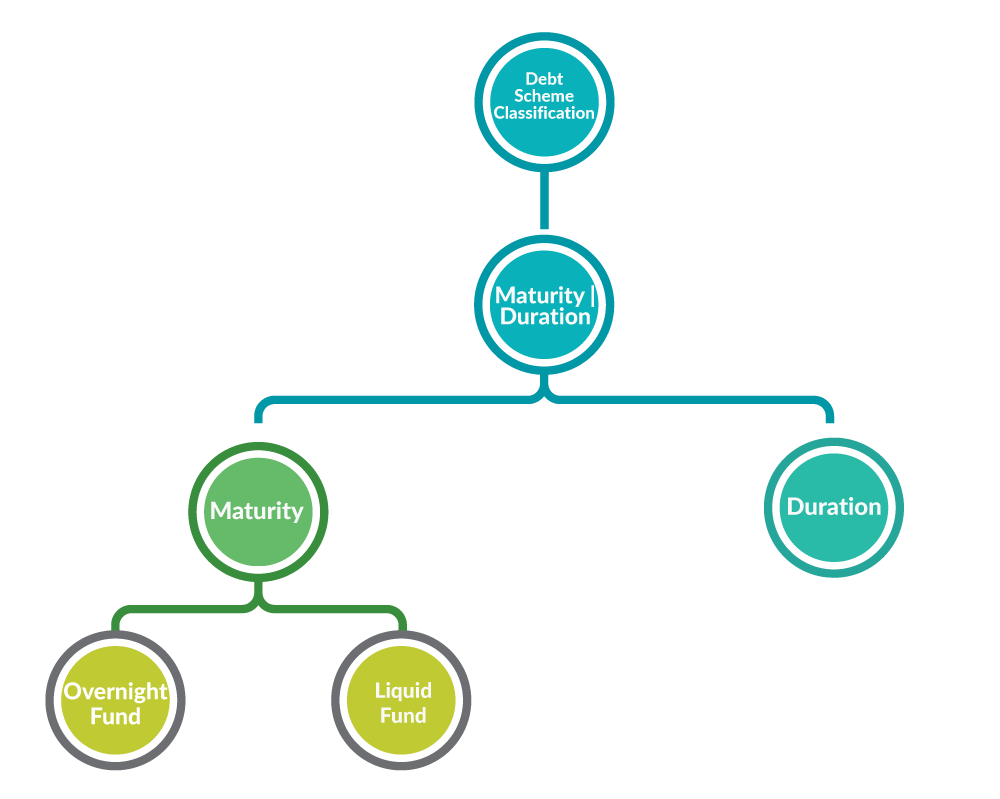

Post re-categorisation of debt schemes, I have 16 categories. But before I start talking about my categories, let me introduce the two main pillars on which this classification rests

- Maturity/ duration

- Scheme Holding

Classification of debt falls in two broad buckets namely duration/maturity and focussed holding. Before talking about the various categories of debt funds, let us understand the aforementioned classification headers.

1. Maturity

- Maturity refers to the date on which the bond issuer will pay back the amount loaned to him

- Based on maturity funds are classified as :

1) Overnight Fund: Invests in overnight securities having maturity up to 1 day

2) Liquid Fund: Invests in securities having maturity up to 91 days

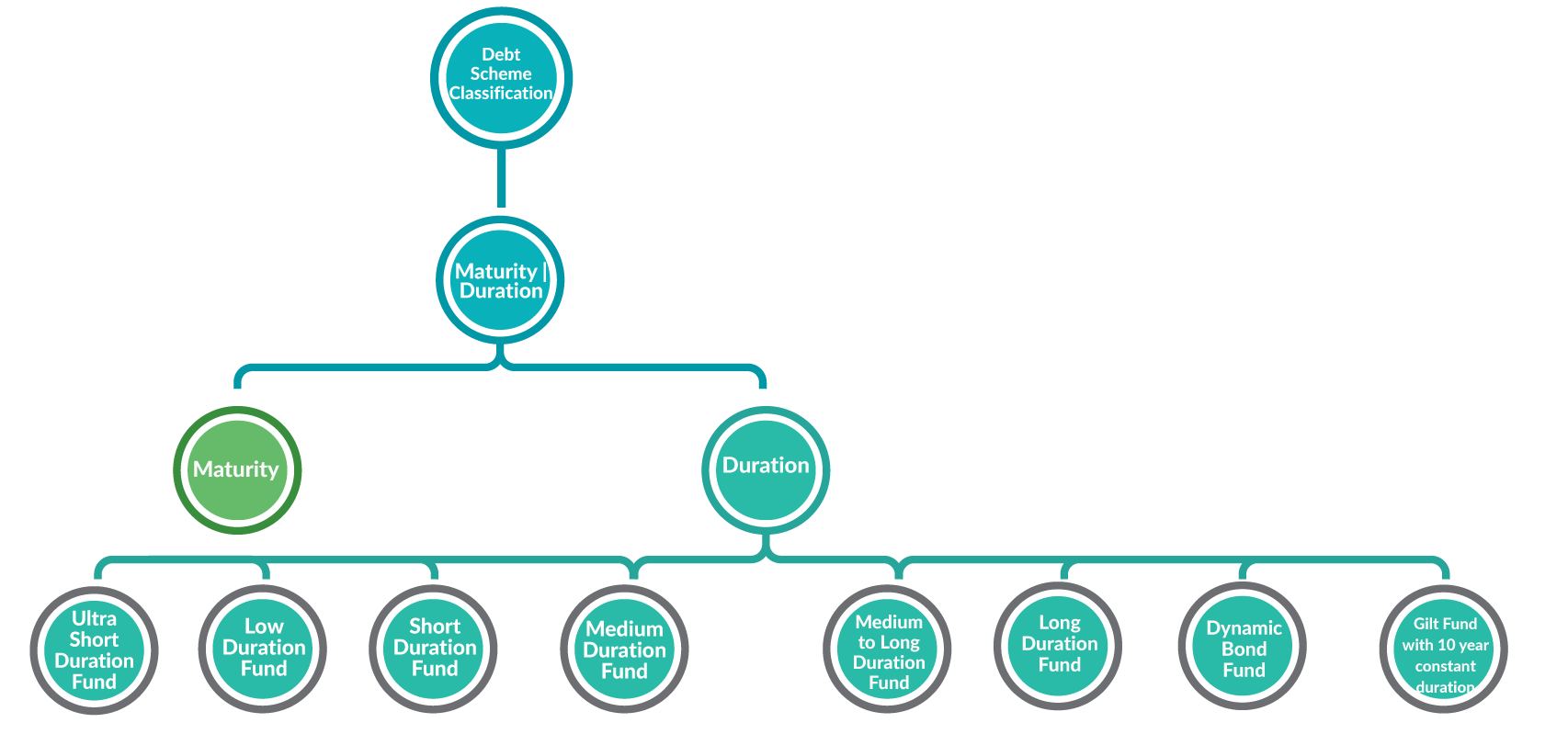

2. Duration

- Macaulay duration indicates the time required to recoup the initial money invested while purchasing the bond

- As bond prices fluctuate with change in interest rates, SEBI categorised funds in order of their duration

1) Ultra Short Duration Fund: Invests in securities such that the Macaulay duration of the portfolio is between 3 and 6 months

2) Low Duration Fund: Macaulay duration of the portfolio is between 6 and 12 months

3) Short Duration Fund: Macaulay duration of the portfolio is between 1 and 3 years

4) Medium Duration Fund: Macaulay duration of the portfolio is between 3 and 4 years

5) Medium to Long Duration Fund: Macaulay duration of the portfolio is between 4 and 7 years

6) Long Duration Fund: Macaulay duration of the portfolio is greater than 7 years

7) Dynamic Bond Fund: Invests in securities across duration. Thus based on the interest rate scenario they can have either low duration or high duration

8) Gilt Fund with 10-year constant duration: Invests up to 80% of the portfolio in government securities such that the Macaulay duration of the portfolio is equal to 10 years

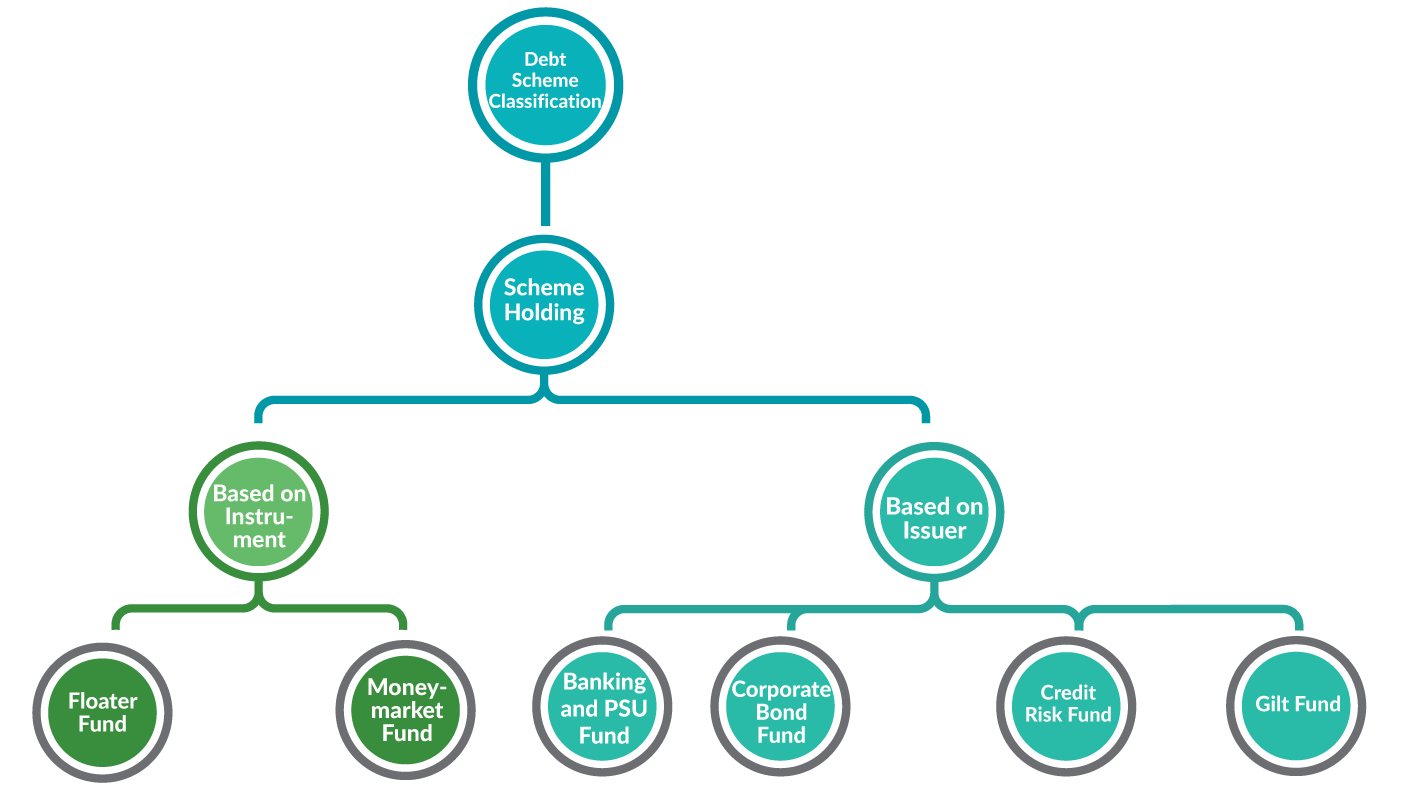

Scheme Holding

Some debt funds adopt the strategy of investing predominantly in a particular category of money market or debt securities such as corporate bonds, government securities. You can consider these funds as focussed investment funds.

- Floater Fund: These schemes invest at least 65% of total assets in floating rate instruments

- Money Market Fund: These schemes invest in Money Market instruments having maturity up to 1 year

- Banking and PSU Fund: These schemes invest at least 80% of the portfolio in securities issued by PSUs and Public Financial Institutions

- Credit Risk Fund:

- Credit rating denotes the bond’s likelihood repayment. Higher the credit rating higher the likelihood of repayment

- They are schemes which predominantly invest (minimum 65%) in lower rated corporate bonds as these bonds pay higher interest to compensate investors for higher credit risk.

- Corporate Bond Fund: These schemes invest at least 80% of the portfolio in highest rated (AAA) corporate bonds

- Gilt Fund: These schemes invest at least 80% of the portfolio in government securities of varying maturity

So did you like my new look?

Signing off- Debt Funds 2.0