Mutual funds and AIFs were among the fastest growing investment options for individuals, says India Wealth Report 2019 by Karvy Private Wealth.

While mutual funds have witnessed a growth of 18% in FY 2019 with assets of Rs.13 lakh crore, AIFs assets grew by 20% to reach 1.50 lakh crore last fiscal.

The report said that investments in MF grew at a faster pace due to the rising popularity of SIPs. There is a net inflow of Rs.3.9 lakh crore in MFs through SIPs in FY19 which is a 38% increase when compared to FY18, says the report.

However, individual investments in international assets grew fastest last fiscal with a healthy growth of 31% to reach Rs.34000 crore. The report states, “Awareness of the benefit of international diversification in combination with a faster depreciating rupee vis-à-vis US dollar would be the likely cause.”.

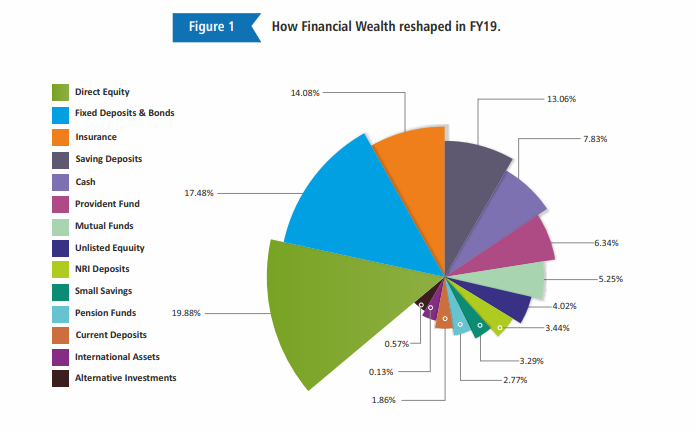

Overall, direct equity, bank FDs, insurance, saving accounts and cash were the top 5 investments in individual assets. Put together, these five investment options account for 72% of the individual financial assets, according to the report.

Despite huge volatility and weak investor sentiment, direct equity inflows grew over 6% at Rs.52 lakh crore. This was followed by 8.8% growth in FDs including government bonds at Rs.45 lakh crore.

Meanwhile, the overall individual wealth in financial assets witnessed an increase of 10.96% to Rs.262 lakh crore as compared to Rs.236 lakh crore in FY18.

Among physical assets, gold and real estate were the biggest contributors. Individual wealth in physical assets increased by 7.59% with gold and real estate together covering 92.57% of this space. In FY19 the total wealth held by individuals in physical form stood at Rs.167 lakh crores.