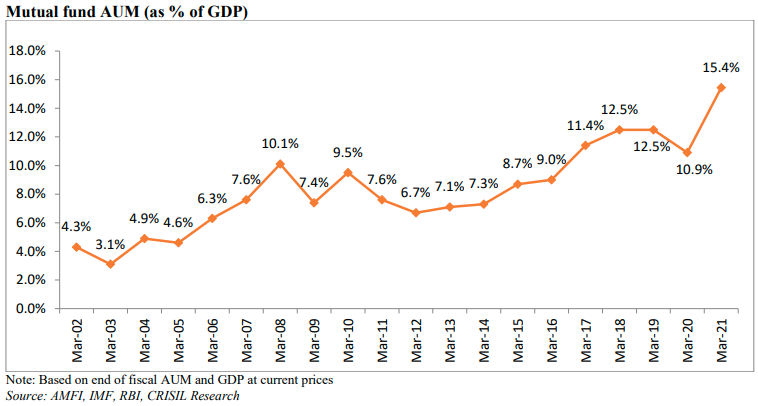

The mutual fund AUM to GDP ratio touched a record high of 15.4% in FY 2021 on the back of a stellar rally in stock markets and a 7.3% decline in India's GDP during the period, shows Prudent Corporate Advisory's draft IPO papers.

In FY 2020, the ratio had plummeted to a 3-year-low of 10.9% mostly due to the Covid-induced crash in the stock market in March 2020. Before the pandemic hit, the AUM to GDP ratio had risen for 6-straight financial years and made a peak of 12.5%.

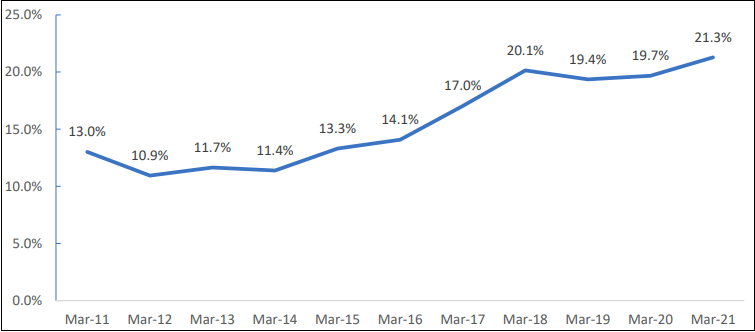

Mutual fund AUM (as a % of total banking deposits)

Mutual fund AUM as a percentage of total bank deposits also made a new peak of 21.3% in FY 2021.

Note: QAAUM for mutual funds considered | Source: RBI, AMFI, CRISIL Research

The document noted that despite the good growth numbers in FY 2021, the industry is still far behind global penetration levels and has ample space to register double digit growth in AUM every year.

"In the long term, i.e. between March 2021 and March 2026, the overall industry’s AUM is projected to sustain a high growth trajectory of 11-13% CAGR, reaching Rs 57 trillion," the document said.

According to it, the growth will be driven by six major factors:

- Pick-up in corporate earnings following stronger economic growth

- Higher disposable income and investable household surplus

- Increase in aggregate household and financial savings

- Deeper regional penetration as well as better awareness of mutual funds as an investment vehicle

- Continuous improvement in ease of investing, with technological innovations and expanding internet footprint

- Perception of mutual funds as long-term wealth creators, driven in part by initiatives like ‘Mutual Fund Sahi Hai’ campaign