Listen to this article

The assets under management (AUM) of the mutual fund industry will double in the next five years to Rs. 74.3 lakh crore driven mostly by double digit growth in AUM of ETFs and equity-oriented schemes, KFin Technologies said in its draft IPO prospectus citing a study by CRISIL Research. Currently, the AUM of MF industry is Rs.37.60 lakh crore as on March 2022.

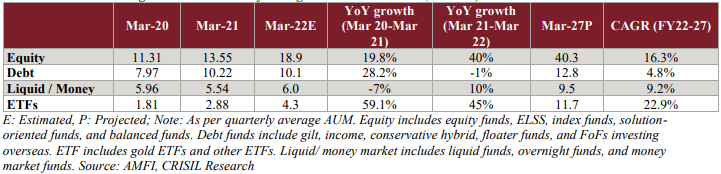

The report estimates that equity AUM (including equity and equity-oriented hybrid funds) is expected to grow 16.3% annually for the next five years to reach Rs. 40.30 lakh crore at the end of FY 2027.

The latest AMFI data shows that the mutual fund industry ended FY 2022 with equity AUM of Rs. 13.60 lakh crore. The AUM of balanced advantage and aggressive hybrid funds amounted to Rs. 3.30 lakh crore and index funds were holding assets worth Rs. 68,676 crore.

Trend in AUM as well as growth across mutual fund segments till March 2027 (in Rs lakh crore):

The report said that the growth in equity-oriented schemes will be driven by retail investors, who are likely to allocate higher share of their savings to mutual funds in the future.

"In the long term, with expectations of higher returns from the capital markets, the fund flow into equity funds is expected to be high. Increasing share of mutual funds in the financial savings of households driven by expectations of higher and stable returns is a key factor that is expected to contribute to fund inflows, especially into passive and equity fund categories," the report said.

Debt fund AUM is projected to grow 4.8% annually for the next five years to reach Rs. 12.80 lakh crore by the end of FY 2027. In the case of liquid and money market funds, the pace of AUM growth is expected to be 9.5%.