Listen to this article

India is gradually coming out of the pandemic. However, the scars of the pandemic are expected to stay with us for quite some time. Retail investors need to relook at the investment strategy to fight the after-effect of the pandemic.

This article is directed towards educating investors to carefully navigate through the economic transition from pandemic to growth without having a dent in their wealth creation journey.

What has been the after-effect of the pandemic?

Today, if there is one common variable that central banks across the world are focusing upon, is the rising Inflation. Pandemic resulted in nationwide lockdown, economic activity got impacted, growth slowed down, demand halted, movement of goods & services got restricted. Thus, RBI had to reduce the interest rates in order to boost consumption. Bringing the interest rates down is the preferred way for central banks to boost economic growth. As rates fall, access to loans gets easier. Businesses and individuals borrow at cheaper rates to deploy the funds in their business. That’s how the ball starts rolling.

Fast-forwarding to today, India is gradually crawling out of the pandemic and interest rates continue to remain low. The resultant impact of this has been that money in circulation is at its historic peak. As you read, system liquidity crossed Rs 8.5 lakh crore (Source: RBI). Cheaper availability of funds resulted in more money in the hands of public. This has resulted in higher inflation at above 7%, (a level above the RBI comfort zone) (Source: Press Information Bureau).

What is the impact of higher inflation on retail investors?

High inflation is expected to remain here and may continue to make RBI uncomfortable for months to come. More so retail investors have been investing in fixed deposits and various government and national saving schemes so far. On one hand, rising inflation percolating into higher prices of food, beverages and essentials are increasing the household expenses. On the other hand, fixed deposits and popular government schemes are fetching interest rates (in the range of 5% to 6%) lesser than current inflation (of above 7%). Thus, rising inflation is causing a double whammy impact on common people.

Why is there a need to recalibrate on investment strategy in rising inflation regime?

Gone are the hay days when India’s interest rates were hovering in double digits. Those were the days when it made sense to invest in fixed deposits and government saving schemes. Inflation was high then too, but the economic growth was also exponential. A lot has changed in the last two decades. India has emerged as one of the largest economic powers. Back then India was growing on a smaller base. Today, India is already the fastest growing economy in the world with a GDP of over $2.5 trillion (Source: International Monetary Fund). One cannot expect India to grow consistently in double-digit on a large base.

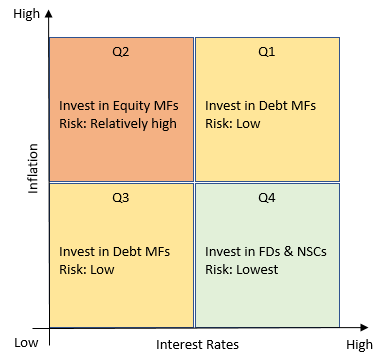

Below matrices may give you investment options to adapt with changing economic dynamics.

We are currently in quadrant 2 where inflation is already high and interest rates are yet to keep pace with it. In such a scenario, money loses its value faster. In high inflation and low-interest regime keeping money idle is the riskiest bet. As money starts losing its value, investors need to find avenues to grow their wealth faster than the deterioration (rising inflation may cause). Thus investing in equities through mutual funds could be a wiser option. Equities have historically proven to consistently beat inflation. However, we advise retail investors not to directly invest in equities given the risks involved and the knowledge required. One may consult his/her financial advisor and invest through mutual funds and aim to beat inflation and generate long term wealth.

To conclude, retail investors need to be cognizant of rising inflation and its resultant impact on their income and wealth. Investors should be equipped with an investment strategy to combat the ghost of the past i.e. the rising inflation caused by the pandemic. An option could be to invest in an equity mutual fund which has a track record of generating returns higher than inflation. One may invest in large cap and large & midcap categories. For conservative investors, a balanced advantage fund could be a category of investment.

Ultimately retail investors’ sole objective should be to invest money in assets that increase the value of their money faster than the devaluation caused by the rising inflation. Accordingly, investors shall be able to manage equity investment risks by investing in SIP mode for a minimum of 3 to 5 years.

T.S. Ramakrishnan is Managing Director & CEO of LIC MF

Disclaimer: This disclaimer informs readers that the views, thoughts, and opinions expressed in the article belong solely to the author, and not necessarily to the author's employer, organization, committee, or other group or individual.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY