Listen to this article

When SEBI banned upfront commission in 2018, the distributor income went down by 20-30%. This income is likely to reduce by 25-50 bps more if SEBI’s proposed TER structure is implemented. Changing dynamics like these and others can impact the overall earning potential of MFDs/IFAs going forward.

In this context, REDVision Technologies, a B2B service provider for MFDs/IFAs suggests creating a diversified product basket that has the potential to achieve 5x business growth.

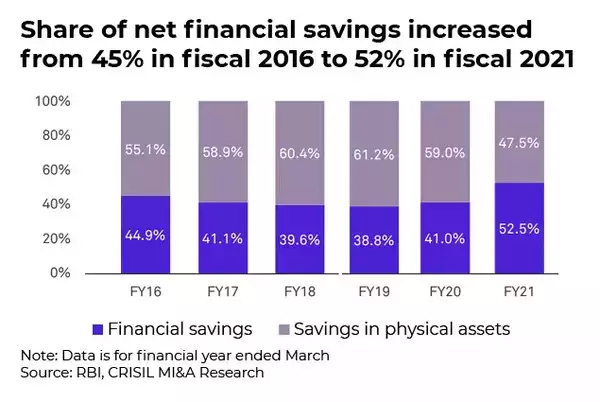

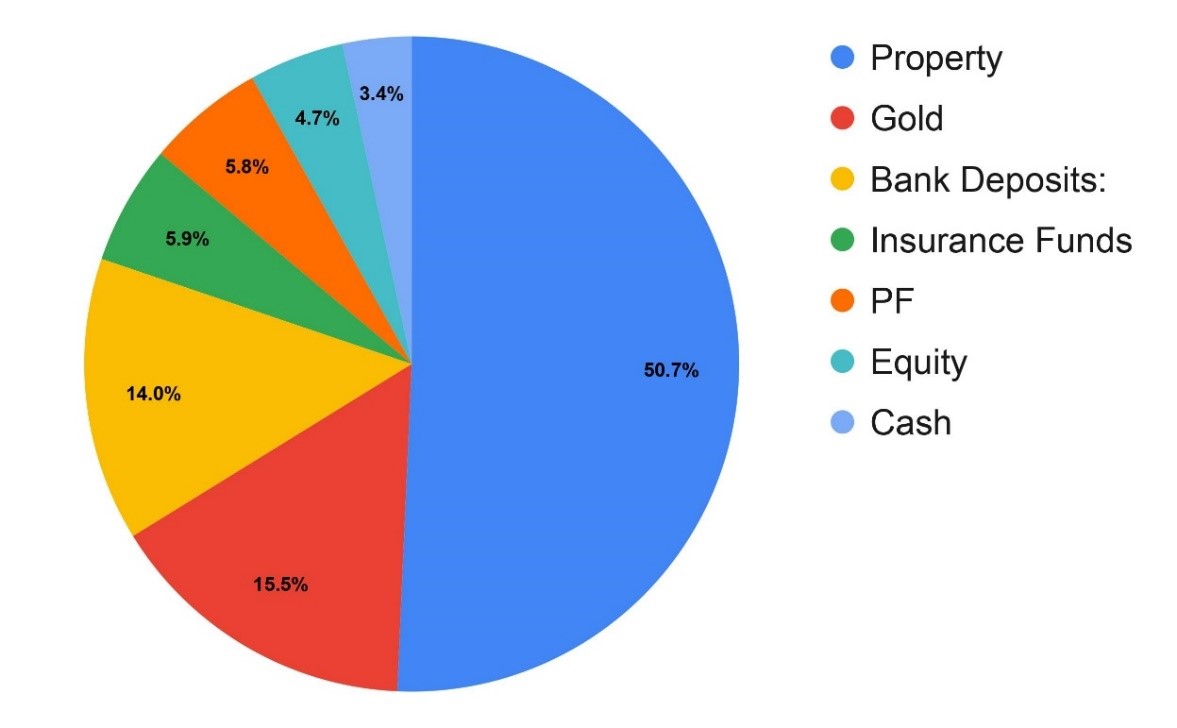

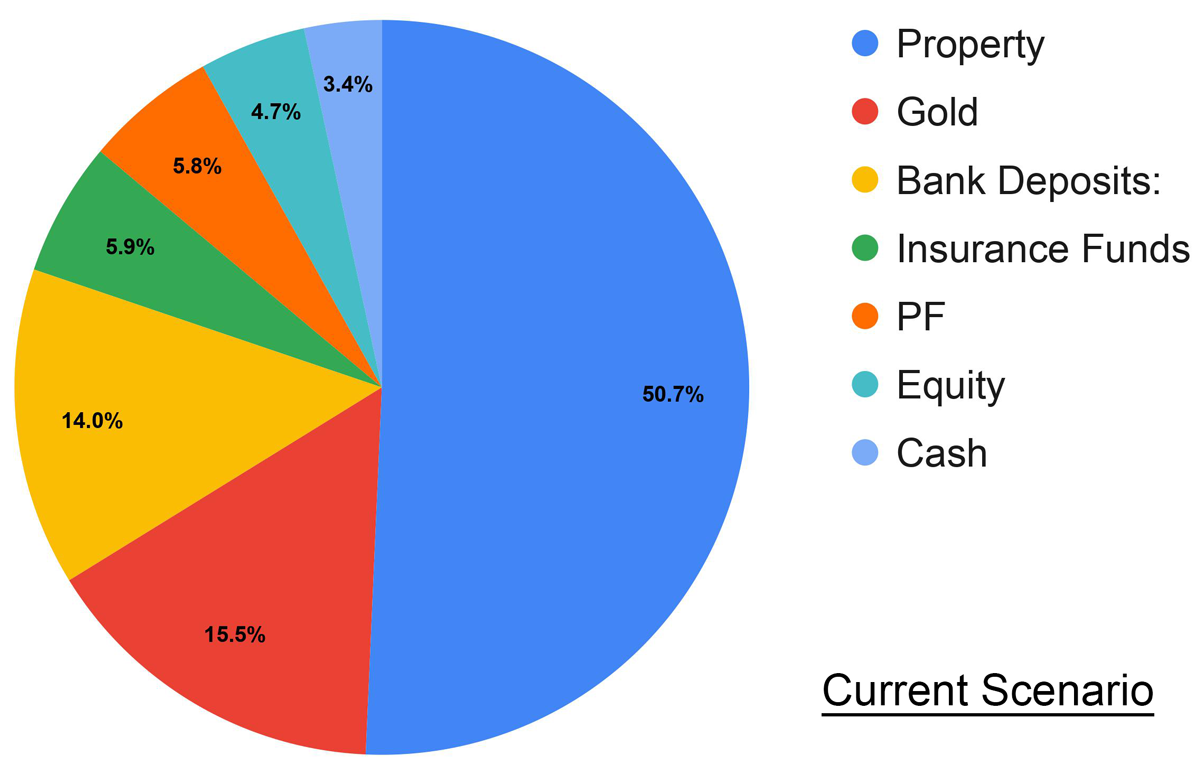

Taking a close look at the current breakup of Indian household financial savings shows that investors largely prefer real estate, gold and bank deposits.

Also, though financial investments have improved over time, physical assets still constitute a major portion.

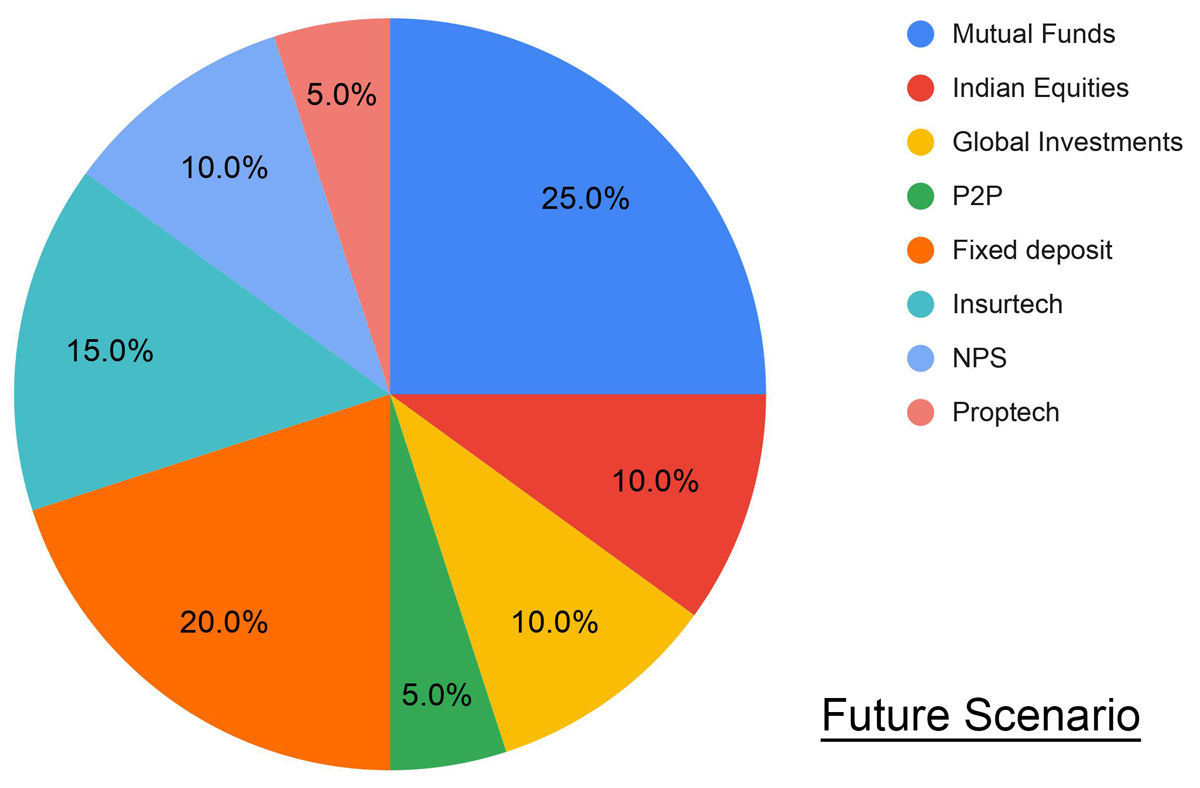

Thus, MFDs/IFAs land up getting a small portion of investors’ wallets. However, they can increase this wallet share by offering real estate, FD (Fixed Deposit), digital gold, NPS (National Pension System), P2P (Peer-to-Peer), Indian equities, global investments, insurance and other products.

This is where REDVision Technologies can provide the needed support to create a multi-asset class transaction capability and get larger investments.

Such multi-asset offerings also result in diversification of revenue stream and most importantly, MFDs/IFAs can provide complete financial solutions under one roof.

The multi-asset approach

The company currently provides an infrastructure to transact in mutual funds, NPS, P2P lending, online ATM and global investments.

Here are the key features of some of these products.

|

Product |

Features/Advantages |

|

Mutual Funds |

Freedom SIP - A combination of SIP and SWP |

|

NPS |

Tax-saving and easy-selling |

|

Online ATM |

Liquid with up to 7% returns (better than banks) and instant redemptions |

|

Global Investments

|

Opportunity to take advantage of currency appreciation and invest in FAANG companies i.e. Facebook, Amazon, Apple, Netflix, and Alphabet (GOOG) (previously known as Google) |

Notably, MFDs/IFAs receive commission directly from the respective third-party product provider. Further, they will soon be able to offer many more products through REDVision Technologies.

|

Product |

Current Transaction Capability |

|

Loan Against Mutual Funds |

Under Integration |

|

Insurtech (Insurance) |

Under Integration |

|

Digital Gold |

Under Integration |

|

Indian Equity |

Under Integration |

|

Proptech (Real-estate) |

Coming Soon |

|

PMS |

Coming Soon |

|

E-Will |

Coming Soon |

|

Bonds |

Coming Soon |

Through the multi-asset approach, MFDs/IFAs can expect not only a larger wallet share but also a change in asset composition as illustrated below.

Also, the company empanels only regulated third-party product providers for creating a multi-product advisory system. These providers fall under the purview of regulators like RBI, FINRA (Financial Industry Regulatory Authority), SEC (US Securities and Exchange Commission).

Moreover, the company use ISO-certified platforms having 256-bit encryption and SSL (Secure Sockets Layer) to ensure security.

Please note that while REDVision Technologies looks into regulatory compliances, it cannot play an active role in the event of payment defaults.

Visit REDVision Technologies to know more.

Disclaimer: This is an educative initiative to make MFDs aware of existing investment avenues and digital platforms. MFDs are advised to perform their due diligence.