Markets slide nearly 10% in last two weeks – What has changed?

-

Mix of global and domestic factors- RBI rate hike & global fears on US, Euro-zone debt and growth outlook.

-

Domestic economy- increased rates, policy inaction could defer a revival in the investment cycle.

-

Global factors- weak US H1 growth @ 1% & economic data fan fears of a double-dip; Euro zone faces debt & growth headwinds too.

-

Asset classes react negatively as risk aversion rises- equities correct, crude and commodities begin easing too.

Weak commodities good for India

-

Crude prices down sharply over last one week ($107 from $113);base metals too have begun to ease.

-

India imports 900mn barrels of crude per annum. Every average $10/bbl fall in crude prices results in savings of $9 billion in forex for India or 0.5% of GDP.

-

Lower global growth = lower demand for commodities and, logicallyower commodity prices.

-

Weaker commodity prices could ease inflationary pressures, agri & manufacturing. Also savings on fuel & food subsidies likely if trend sustains . Operating margins which have come down on an average by 200-300 bps in manufacturing could see upsides. Big lever for earnings growth.

-

Both are positive for India’s macro- lower inflation & lower subsidy burden.

-

Earnings for levered sectors (capital goods, utilities, infrastructure, and consumer) could see support from lower input prices.

Strategy- High Volatility offers opportunity : Invest Now

-

Broader market prospects hinged on global and domestic cues in the near term.

-

Over medium term – underlying trends (weaker crude and base metals) likely to offer relief on two pain points – inflation & subsidies.

-

Increased possibility of rate cycle peaking out as inflationary pressures moderate. With this fall, it is likely that RBI may take the foot of the pedal in terms of hiking rates further. Strong reason for Indian markets to go up.

-

FII flows have been positive this year (USD 2 bn). Contradictory to negative flows in the rest of the region. This is despite India being an underperforming market in the region. Why? Because valuations are getting attractive and longer term growth is intact.

-

Q1FY12 earnings inline so far; expect corporate growth of 15% for Fy12.

-

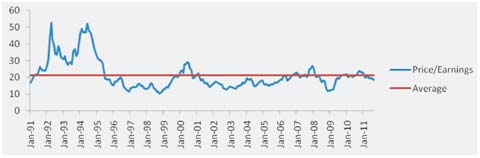

Markets currently trading at approximately discount to longer term average of 21.3x (Trailing PE) – providing opportunity for longer term investors.

Ravi Gopalakrishnan is Executive Director & CIO – Equity in Pramerica Mutual Fund