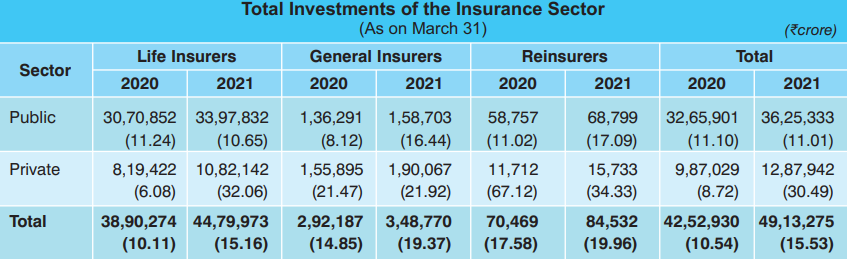

The assets under management (AUM) of insurance industry has surged 15.5% to Rs. 49 lakh crore in FY 2020-2021, according to IRDAI's Annual Report 2020-2021. The impressive growth came on the back of a strong post-covid rally in equity market.

The AUM registered a sharp rise despite the fact that premium collection registered only a marginal growth of 0.1% in FY 2020-2021.

Of the total AUM, life insurers have a share of 91%, followed by general insurers and stand-alone health insurers (SAHI), who together hold 7.1% share. Reinsurers hold the rest 1.7% share, shows IDRAI data.

Source: IRDAI Annual Report 2020-2021

LIC alone has an AUM of Rs. 33.97 lakh crore, which is almost 70% of the total AUM of the insurance industry and higher than the total size of the MF industry (Rs. 31.4 lakh crore) at the end of March 2021.

However, the growth registered by private life insurers was much higher than that of LIC. While the AUM of LIC rose 10.6%, private insurers registered a 32% surge in FY 2020-2021. In fact, private players were ahead of public insurance companies in the other two verticals (general insurance and reinsurers) as well.

Overall, the AUM of public sector players went up 11% to Rs. 36.25 lakh crore at the end of March 2021. With a growth of 30%, private insurers ended FY 2020-2021 with an AUM of 12.87 lakh crore.

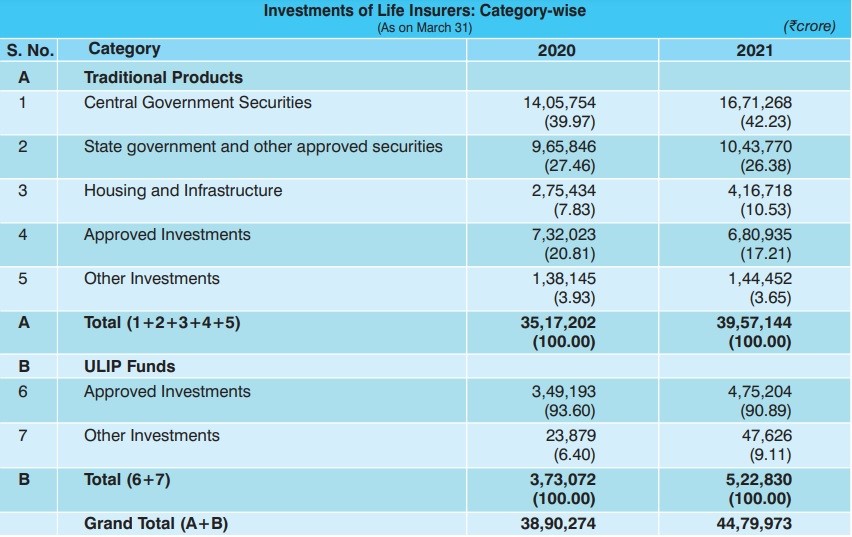

According to the report, a large portion of the corpus of life insurers is invested in debt instruments, mostly issued by the Central and state governments.

IRDAI regulations mandates life insurance players to invest a minimum of 50% of the corpus in government bonds.

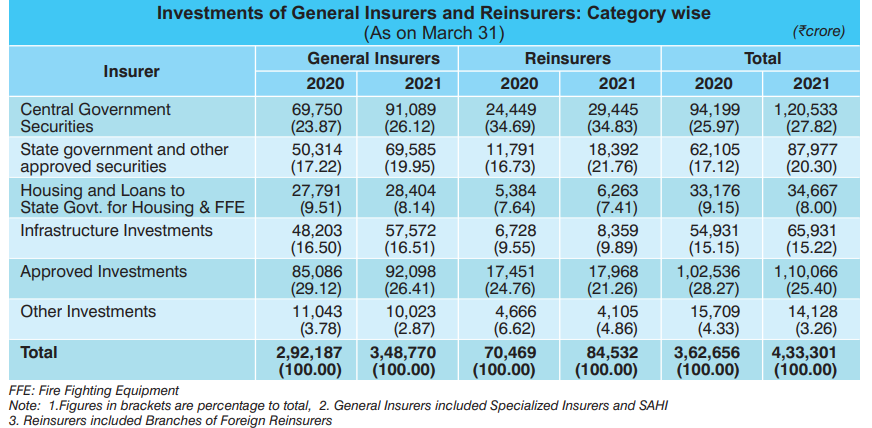

In the case of general insurance and reinsurers, the investment in government bonds is comparatively lower.