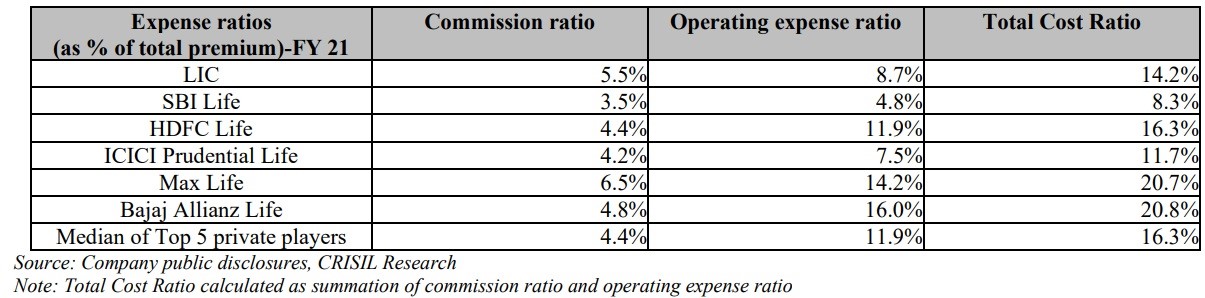

Max Life and LIC are the highest commission paying life insurers in India as their commission outgo is in excess of 5.5% of their total premium income, shows LIC's draft IPO prospectus.

Max Life pays the highest commission to agents. The private insurer has disbursed 6.5% of its total premium income to its agents as commission in FY 2021. LIC comes in next with commissions amounting to 5.5% of total premium.

In FY 2021, Max Life and LIC have collected total premium of Rs. 19,020 crore and Rs. 4,03,290 crore respectively. This implies that Max Life has paid Rs. 1,236 crore and LIC disbursed Rs. 22,180 crore as commission in the previous financial year.

Among the top five private players, SBI Life pays the least percentage of premium as commission at 3.5% (FY2021). Agents of HDFC Life, ICICI Prudential Life and Bajaj Allianz Life have received commission of 4.4%, 4.2% and 4.8% respectively in FY 2021.

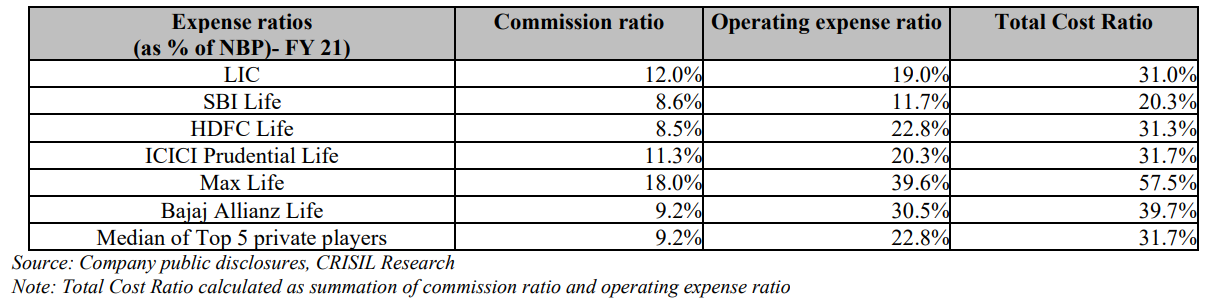

Comparing the commission payment with new business premium (FY 2021) shows that Max Life has the highest commission ratio at 18%, followed by LIC (12%) and ICICI Prudential Life (11.3%).

The high commission payouts reflect the high dependence of life insurers on individual agents. In the draft IPO prospectus, LIC states that its individual agents’ network contributed approximately 94% of its new business premium in FY 2021.