Super investors tend to own more than one life insurance policy and intend to buy more policies, finds a Nielsen survey titled ‘Super Investors: India’s New Wealth Generators’.

Nielsen defines super investor as a more active, prolific and aware consumer having a higher risk appetite than the average consumer.

Of the super investors Nielsen polled, 75% were male and aged 35 to 45 years. In case of mutual fund investors, the average age was between 30 to 40 years. 94% investors were from Bangalore, Pune and Mumbai.

Super investors consider investing in life insurance as ‘saving’ as well as ‘investment’. “They own at least 3 life insurance policies and the average life cover is above Rs.9 lakh, nearly three times that of a regular investor,” shows the survey. They also invest in pension funds.

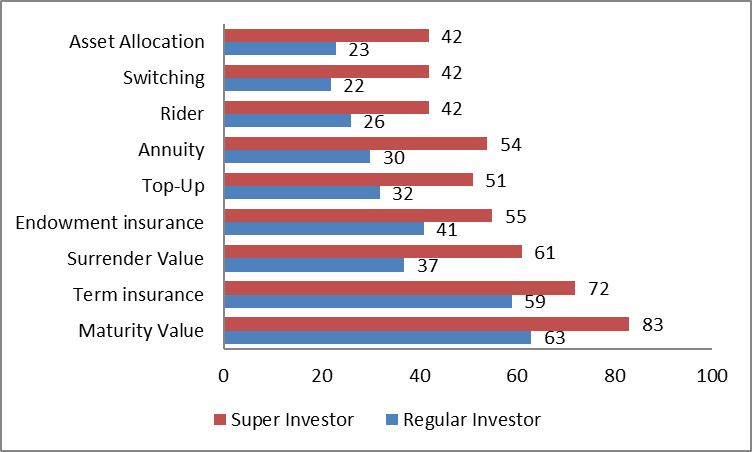

Awareness of insurance terms

Super investors do not prefer to consult relationship managers for insurance needs. Rather, they like to buy policies online. The survey finds that super investors have an easy access to internet and use it for bill payment and fund transfers. “In the case of insurance premium payments, most super investors expressed their preference for making online payments or using electronic clearance systems (ECS). Nearly 81% of super investors said they were more inclined to purchase policies online instead of through an agent to speed up the process,” shows the report.

The survey recommends that the best way to approach super investors is by continuously engaging with them. A dedicated service manager would be one way of building this relationship. It advises that frequent contact will advisors acquire more super investors.