Mirae Asset Knowledge Academy

Yield can be measured in two ways: Current Yield and Yield to Maturity

Yield to Maturity is the most popular measure of yield in the Debt Markets. YTM refers to the rate of return an investor receives if the investor holds on to the bond till its maturity

The calculation for YTM is based on the coupon rate, the length of time to maturity and the market price of the bond. YTM is basically the Internal Rate of Return on the bond. One of the major assumptions underlying the YTM is that the coupon interest paid over the life of the bond is assumed to be reinvested at the same rate.

The yield to maturity is found in the present value of a bond formula:

For calculating yield to maturity, the price of the bond, or present value of the bond, is already known. Calculating YTM is working backwards from the present value of a bond formula and trying to determine what r is.

Current Yield is the coupon rate divided by the Market Price and gives a fair approximation of the present yield.

Yield Price Relationship :

Yield and price have inverse relationship that is to say, when a bond’s price falls its yield rises and vice-versa. When prevailing interest rates rise, prices of outstanding bonds fall to bring the yield of older bonds into line with higher-interest on new issues

Variants of yield to maturity

As some bonds have different characteristics, there are some variants of YTM:

- Yield to call: when a bond is callable (can be repurchased by the issuer before the maturity), the market looks also to the Yield to call, which is the same calculation of the YTM, but assumes that the bond will be called, so the cash flow is shortened.

- Yield to put: same as yield to call, but when the bond holder has the option to sell the bond back to the issuer at a fixed price on specified date.

- Yield to worst: when a bond is callable, puttable, exchangeable, or has other features, the yield to worst is the lowest yield of yield to maturity, yield to call, yield to put, and others.

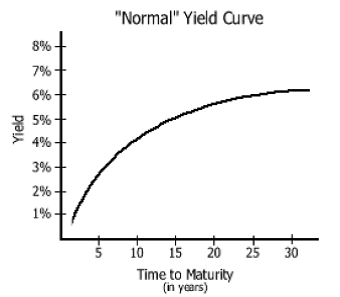

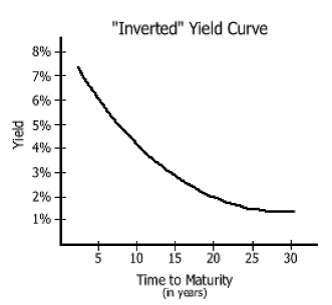

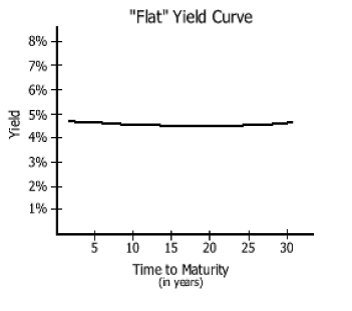

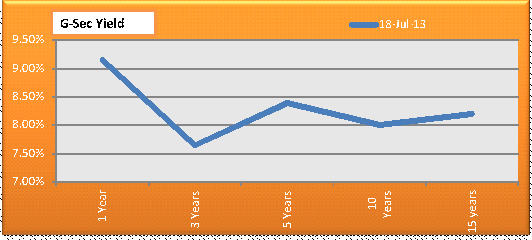

Yield Curve

The slope of a yield curve is a good indicator of the economic activity. The yield curve also reflects the investors view about the future interest rates.

Normal or Upward Sloping Yield Curve: An upward sloping or steep yield curve indicates an economic upsurge. This states that the economic growth will bring in high inflation which would lead the central banks to increase the interest rates to control the inflation.

Inverted Yield Curve : The inverted yield curve indicates that the market currently expects interest rates to decline as time moves farther into the future, which in turn means the market expects yields of long-term bonds to decline. This usually indicates economic contraction. Interest rate decline is expected in the future. As interest rates decline, bond prices will move higher and yields will decrease. This may be the result of central banks loosening the monetary policy to revive the economy.

Flat Yield Curve: Sends mixed signals that short-term interest rates will rise and other signals that long-term interest rates will fall. This may indicate a transitionary period to economic expansion or contraction. A flat curve indicates slowdown of economy. This usually happens when central banks try to contain inflation by increasing interest rates, thus increasing short term yields. However, with the actions taken, the expectations of high inflation begin to subside to moderate inflation and expectations of higher long term rates also fall.

Current Yield Curve

Source: Bloomberg, July 19, 2013

We will explain Debt fund valuations in the next edition on Mirae Asset Knowledge Academy Tutorials.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.