Money supply is the amount of money in circulation in the economy at any point of time. It not only includes the currency & coins in circulation, but it also includes demand & time deposits of banks, post office deposits and such related instruments. Valuation and analysis of the money supply helps the economist and policy makers to frame the policy or to alter the existing policy of increasing or reducing the supply of money. The understanding of money supply is important as it ultimately affects the business cycle and thereby affects the economy. Periodically, every country's central bank publishes the money supply data based on the monetary aggregates set by them.

The different types of money are typically classified as "M"s. The "M"s usually range from M0 (narrowest) to M3 (broadest) but which "M"s are actually focused on in policy formulation depends on the country's central bank. In India, the Reserve Bank of India follows M0, M1, M2, M3 and M4 monetary aggregates.

The Reserve Bank of India defines the monetary aggregates as:

M0 (Reserve Money): Currency in circulation + Bankers’ deposits with the RBI + ‘Other’ deposits with the RBI = Net RBI credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities.

M1: Currency with the public + Deposit money of the public (Demand deposits with the banking system + ‘Other’ deposits with the RBI).

M2: M1 + Savings deposits with Post office savings banks.

M3: M1+ Time deposits with the banking system = Net bank credit to the Government + Bank credit to the commercial sector + Net foreign exchange assets of the banking sector + Government’s currency liabilities to the public – Net non-monetary liabilities of the banking sector (Other than Time Deposits).

M4: M3 + All deposits with post office savings banks (excluding National Savings Certificates).

That relation between money and prices is historically associated with the quantity theory of money. There is strong empirical evidence of a direct relation between money-supply growth and long-term price inflation, at least for rapid increases in the amount of money in the economy. That is, a country such as Zimbabwe which saw rapid increases in its money supply also saw rapid increases in prices (hyperinflation). This is one reason for the reliance on monetary policy as a means of controlling inflation.

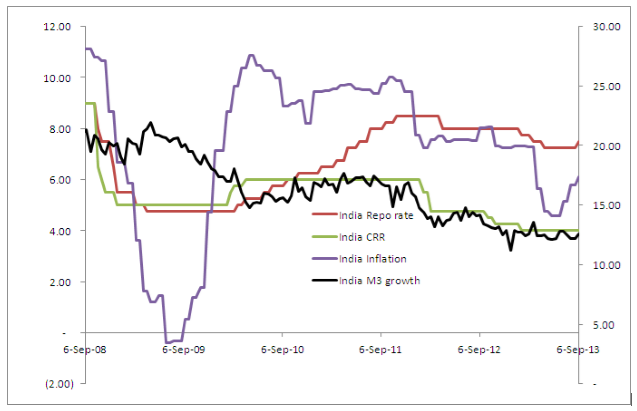

Reserve Bank of India controls monetary policy tools like repo, reverse repo, CRR, SLR to manage money supply in the economy. The below mention graph represents RBI`s policy stance and its impact on the money supply (M3) in the economy.

Source: Bloomberg

Currently,

M3 money supply rose an annualized 12.6% in the fortnight ending Sept. 6 2013, slower than 14.2 % a year earlier; Money supply was 88.36 trillion rupees as of Sept. 6 2013. The reserve money (M0) rose 8.3% in the week to Sept. 13 2013.

Currency in circulation rose 9.8% year-on-year in the week to Sept. 13 2013, compared with 12.4% a year earlier.

We will explain concepts of P/E Ratio in the next edition on Mirae Asset Knowledge Academy Tutorials.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.