Investing by considering only historical returns in a mutual fund scheme is risky. Investors need to evaluate the risk involved in mutual fund schemes before investing. In this article we will cover significance of Sortino Ratio.

Sortino Ratio

Definition:

Sortino ratio is the statistical tool that measures the performance of the investment relative to the downward deviation.

The Sortino ratio is similar to the Sharpe ratio, except it uses downside deviation for the denominator instead of Standard Deviation (SD). Standard deviation involves both the upward as well as the downward volatility. Since investors are only concerned about the downward volatility, Sortino ratio presents a more realistic picture of the downside risk ingrained in the fund or the stock.

The ratio was named after Frank A. Sortino.

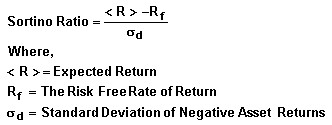

Computation:

Sortino ratio subtracts the risk-free rate of return from the portfolio’s return, and then divides that by the downside deviation. A large Sortino ratio indicates there is a low probability of a large loss.

Example: Assume investment A has a return of +10% in year one and -10% in year two. Investment B has a 0% return in year one and a 20% return in year two. The total variance in these investments is the same, i.e. 20%. However since there is negative volatility associated with Investment A, Investment B will be the more suitable option.

Significance

· The formula does not penalize a portfolio manager for volatility, and instead focuses on whether returns are negative or below a certain threshold.

· Sharpe ratios are better at analyzing portfolios that have low volatility while Sortino ratio is better when analyzing highly volatile portfolios.

· A large Sortino ratio indicates there is a low probability of a large loss.

We will explain Portfolio Turnover Ratio and its significance in the next article.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.