Prudent Investing - III

In continuation with our previous article on Asset Allocation, we will further discuss the importance of Asset Allocation.

Historically, the returns of the three major asset categories (Equity, Debt and Gold) have not moved up and down at the same time. Market conditions that cause one asset category to do well often cause another asset category to have average or poor returns. By investing in more than one asset category, you may reduce the risk that you'll lose money and your portfolio's overall investment returns may have a smoother ride.

A well-diversified plan will not outperform the top asset class in any given year, but over time it may be one of the most effective ways to realize your long-term goals.

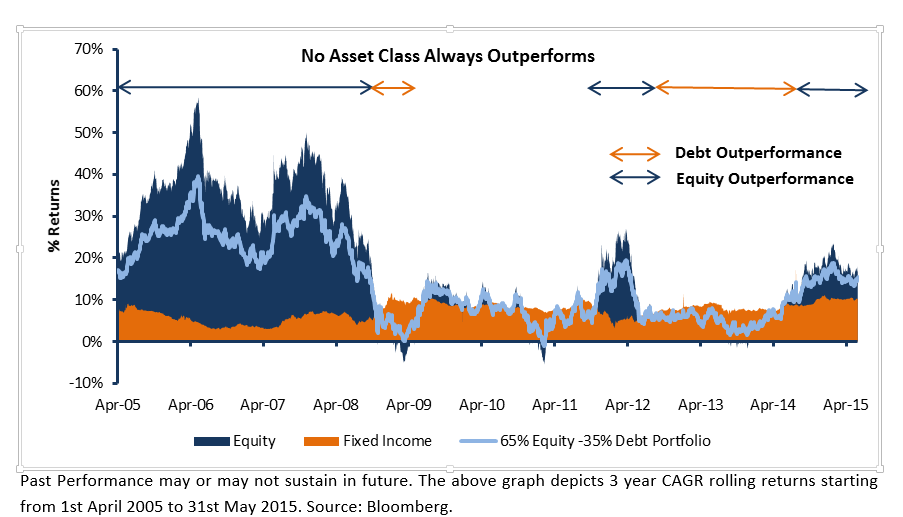

1. No Asset Class Always Outperforms:

As explained by the example above a balance portfolio of Equity and Debt helps provide the most optimal portfolio returns for investors.

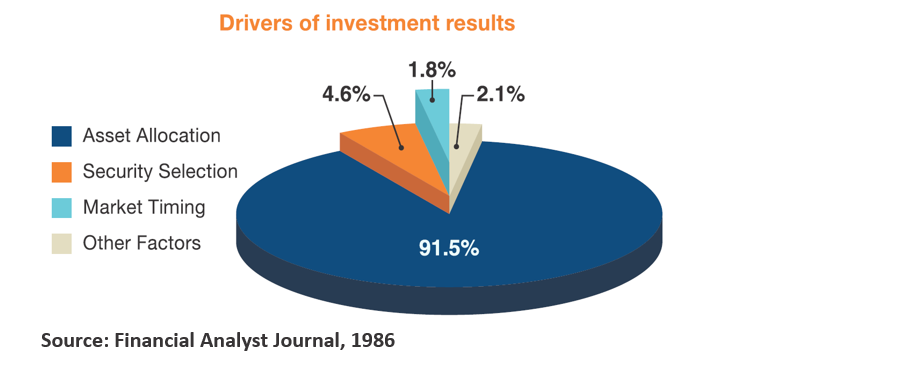

2. Asset Allocation Strategy drives Investment Returns:

Investors are often surprised to learn that a significant percentage of the volatility of investment performance is driven by asset allocation decisions - hence asset allocation is the key of long term wealth.

Investors focus on factors like market timing and security selection instead of asset allocation which may yield the maximum results as shown by chart below:

Watch out this space for more, next we will cover “Balance between Risk and Reward”

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.