In order to encourage savings, the government gives tax breaks on certain financial products under Section 80C of the Income Tax Act. Investments made under such schemes are referred to as 80C investments.

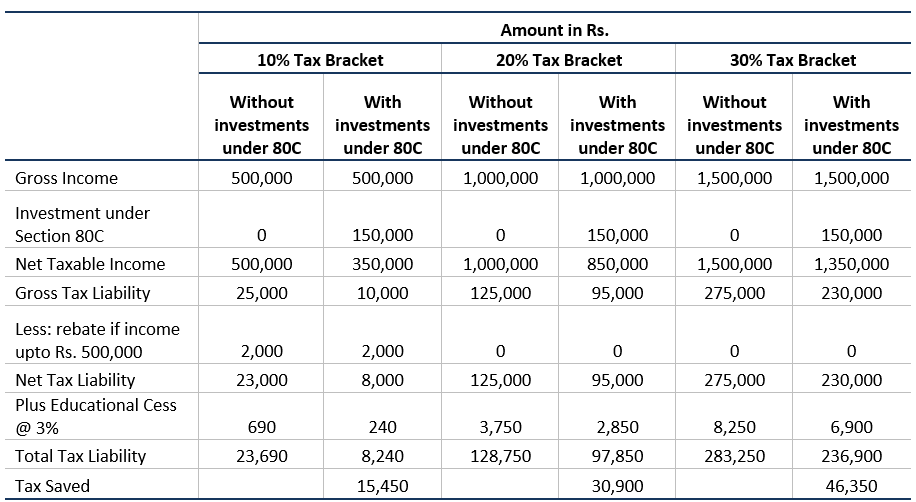

Section 80C of the Income Tax Act, 1961 allows certain investments and expenditure up to the maximum of Rs. 150,000/- to be deducted from total income for tax computation of the current Financial Year and if you are in the highest tax bracket of 30%, you save a tax of Rs 46,350/- as illustrated in the table below:

Features of SECTION 80C:

- The deduction under section 80C is from your Gross Total Income

- Available to an Individual or a HUF

- The limit of deduction for current financial year is Rs 150,000

- It is available to everyone, irrespective of his or her income levels

The various investment options under this section include:

- Provident Fund (PF) & Voluntary Provident Fund (VPF): PF and VPF is deducted directly from your salary by your employer.

- Public Provident Fund: An account can be opened with a nationalized bank or Post Office.

- National Savings Certificate: These are 6-years small-savings instrument, where the rate of interest is 8% and is compounded half-yearly.

- Equity-Linked Savings Scheme (ELSS): Mutual funds offer you specially-created tax saving schemes called ELSS.

- Life Insurance Premiums: Any amount that you pay towards life insurance premium for yourself, your spouse or your children can be included in section 80C deduction.

- Home Loan Principal Repayment: The principal component of the EMI qualifies for deduction under Section 80C.

- Stamp Duty and Registration Charges for Home: The amount you pay as stamp duty when you buy a house and the amount you pay for the registration of the documents of the house can be claimed as deduction under section 80C.

- Five-Year Bank fixed deposits: Tax-saving fixed deposits (FDs) of scheduled banks with a tenure of five years are also entitled for section 80C deduction.

- Others: Apart from the above, things like children's education expenses that can be claimed as deductions under Section 80C. However, you need receipts to claim the same.

Comparison of risk and returns of various options under 80C:

Tax planning should not only be aimed at saving taxes but also to aid your investments to help you achieve your financial goals. While there are many schemes that are offered to save taxes, ELSS can be used to save taxes as well as for wealth generation as it invests heavily in Equities to ensure the desired long term yields.

Disclaimer

@ Tax benefits are subject to the provisions of the Income Tax Act, 1961 and are subject to amendments, from time to time.

Certain information contained in this document is compiled from third party sources. Whilst Mirae Asset Global Investments (India) Private Limited has to the best of its endeavor ensured that such information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, it shall have no responsibility or liability whatsoever for the accuracy of such information or any use or reliance thereof. This document shall not be deemed to constitute any offer to sell the schemes of Mirae Asset Mutual Fund. Mirae Asset Global Investments (India) Pvt. Ltd/ Mirae Asset Trustee Co. Pvt. Ltd./ Mirae Asset Mutual Fund/ its Directors or employees accepts no liability for any loss or damage of any kind resulting out of the unauthorized use of this document.

Mutual funds are subject to market risks, read all scheme related documents carefully.