Small cap funds are very volatile as the stock in these funds have low free float and prices are highly volatile. Fast growth is the hallmark of these investments. Small cap funds seek out companies that exhibit very rapid growth. Of course, aggressive growth can also mean aggressive risks, so advisors should take these factors into consideration before recommending them to their clients. However, these growth assets can be promising if they are seen as long term investments.

Investing in small caps require more due diligence. Vivek Rege from VR Wealth Advisors says, “Performance especially worst three months return, portfolio size, standard deviation from its benchmark are a few important factors to be evaluated while doing due diligence of these funds.”

Your client’s money invested in small caps funds is exposed to a higher degree of risk. Small companies are illiquid, so investments in these stocks present more risk than investments in those of larger, more established companies.

Definition of small cap can vary from fund to fund. For example HSBC Small Cap Fund defines small cap companies as companies with a market capitalization 1) lower than or equal to the market capitalization of the stock in the BSE Small Cap Index with the largest market capitalization and 2) higher than or equal to the market capitalization of the stock in the BSE Small Cap Index with the smallest market capitalization. (Source: www.assetmanagement.hsbc.com/in).

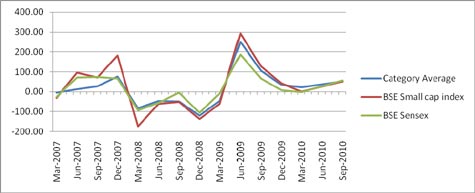

If we take past three years in to consideration, we have seen an entire cycle peak and trough. Our analysis proves that small cap funds have plunged maximum compared to BSE Sensex, a basket of the largest and most active 30 stocks, during the market crash in 2008. And surge the most in the market rally.

Looking at the analysis should one time the market to invest in small cap funds?

According to Rege, Indian investors have not graduated to a level whereby they can differentiate between funds. One should appreciate the risk associated with the fund and also understand the fact that how much monitoring is required.

Disclaimer: We have considered DSPBR Micro-Cap (G), HSBC Small Cap (G), ICICI Pru Child Care Plan-Gift Plan, L&T Small Cap (G) and Sundaram BNPP Select Small Cap (G) to calculate category averages.

Source: Accord Fintech.

Advise your clients to add up small cap funds to their portfolio because small cap stocks can unlock immense value once the business evolves and matures. Risk associated with these types of stocks as follows:

-

Major concern should be its volatility and illiquidity. Small cap stock prices rise quickly in an up rally and also fall equally fast in bear markets. These stocks are very illiquid. Here there may be instances where fund managers bet on a particular stock can go wrong, losing money invested in that stock.

-

Small cap fund should definitely be part of diversification strategy for clients with a high risk appetite. It is advisable to invest for long term, as it averages out the volatility risk associated with these stocks.

Who should you recommend to invest?

-

Only investor with good risk appetite should consider small cap funds.

-

Long-term investor.

-

Not for clients who seek regular dividend income as small cap stocks don’t declare dividend and use the profit for further expansion of business.