Often, when we talk about trust and confidentiality, a hurdle which every advisor faces is how to win the trust of your prospect. When it comes to friends and family, we share important details with them knowing that they will not make the information public. We build these relationships over a lifetime.

But when it comes to engaging with an advisor, clients hesitate to share their very personal information with a total stranger. What a client expects from you is to keep these details in the strictest confidence and only disclose it with their permission.

So how do you build the trust of your clients? Today’s investors are one of the most informed segments of population. They do not have unrealistic expectation and are aware about the nature of volatile markets. The world of advisor-client relationship has changed. A thorough understanding of the changing dynamics within the advisor-client relationship is going to be essential in training and supporting in their efforts to attract, serve and develop loyalty with their affluent clients.

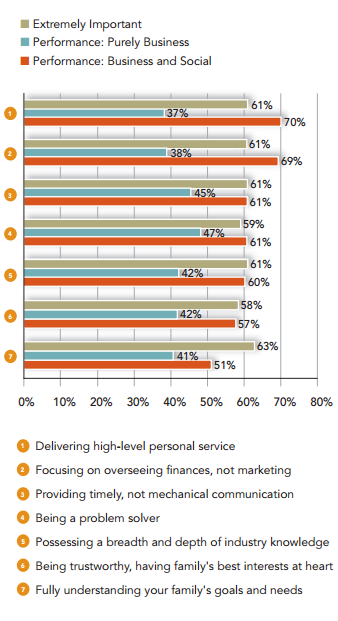

A whitepaper published by First Clearing on ‘New World Realities of the Advisor-Client relationship’ shows that there are three significant criteria today’s affluent investor consider important regarding the advisor-client relationship. They are:

- Fully understanding a client’s family goals and needs

- Being trustworthy and having their family’s best interest at heart

- Providing timely, personal, non-mechanical communication

“These three criteria personify the transformation in the advisor-client relationship. It might help to think of them as the framework within which this new-world advisor-client relationship exists. When financial professionals are able to meet expectations in these three areas, they have put themselves in a position in which they can take the necessary steps to deepen relationships. However, if any of these three expectations aren’t currently being met, advisors must make closing these gaps a top priority,” finds the whitepaper.

So how do you realize that a client is not happy with you? Affluent client expectations are not being met if their advisors maintain a purely business relationship. A survey shows that financial professionals who helped both a business and social relationship with an affluent client enjoyed more trust than that of the advisors who had only a business relationship.

The survey shows that advisors who had purely business relationship recorded negative performance gaps (the gap between importance and performance) in the area of financial planning. On the other hand, advisors with both business and social relationship enjoyed a positive performance gap.

You can create more social and friendly environment with your clients through affluent communication workshops, fun events, lunch or dinner parties, etc. the research shows that many financial professionals possess varying degrees of social self-consciousness. This means that they are uncomfortable in affluent social circles and are hesitant while starting a conversation.

Communication

When asked clients which area a financial advisor could improve upon, majority of the respondents said communication. Although ‘meeting investment performance expectations’ is a critical area within the financial services grouping, it completely depends on the way of communication.

What do affluent clients consider excellent communication in today’s world? Is it something that can be in the form of e-newsletters and email updates? Or should a financial professional’s communication with their affluent clients be more personal?

The survey shows that advisors who have developed both business and social relationship with clients are more successful than others. "Communication and service must be made personal in order for financial professionals to successfully strengthen the relationship with their affluent clients," states the study.

Here’s how you can overcome the barrier of communication:

- Understand the difference between mechanical contact and personal interaction. Face-to-face contact over a non-business lunch is both personal and social.

- A personal phone call to the spouse to offer congratulations on her son’s high school graduation is both personal and social, whereas a programmed email birthday greeting is mechanical.

These ideas are not very complicated but how you implement is crucial. Earlier, convincing investors was very difficult for IFAs but they are now more informed and want you to help them in meeting their financial goals.