The new generation of Indian investors is more open to market risks and is eagerly opting for ‘riskier’ investment options like mutual funds and stock markets, indicates data points from various sources.

In the Parliament, government recently presented data that showed the declining investor interest in small savings schemes. As per the data, opening of new small savings accounts is shrinking for the last three financial years at least. In FY 2018-19, over 4.6 crore new accounts were registered. The figure dropped to 4.12 crore in FY 2019-20 and 4.11 crore in FY 2020-21.

The figure is likely to drop further this financial year (FY 2021-2022) as only 2.3 crore accounts were registered by the end of November.

New account additions in each financial year (in lakh):

|

Scheme |

2018-19 |

2019-20 |

2020-21 |

2021-22 (till Nov) |

|

Post Office Savings Account |

118.1 |

89.1 |

72.1 |

41.5 |

|

National Savings Recurring Deposit Scheme |

125.7 |

99.1 |

119.2 |

65.3 |

|

National Savings Time Scheme |

84.8 |

69 |

81 |

54.3 |

|

National Savings Monthly Income Scheme |

19.7 |

11.6 |

17.7 |

12.7 |

|

Senior Citizen Savings Scheme |

12.6 |

12.2 |

11.4 |

4.7 |

|

Public Provident Fund |

11.5 |

27.2 |

19.6 |

3 |

|

Sukanya Samriddhi Account Scheme |

31.4 |

37.2 |

40.2 |

23.4 |

|

Kisan Vikas Patra |

26.9 |

30.3 |

21.5 |

13.2 |

|

National Savings Certificate |

35.2 |

36.2 |

28.1 |

15 |

|

Total |

465.9 |

411.9 |

410.8 |

233.1 |

Among the nine small savings schemes, only Sukanya Samriddhi and PPF have witnessed a surge in new account openings in FY 2020-2021 as compared to FY 2018-2019.

On the other hand, new accounts are being added at a record pace in mutual funds and stock markets.

In another response in the Parliament, the government said the number of demat accounts was 3.59 crore at the end of FY 2018-19. It rose to 4.06 crore next year and further to 5.51 crore by the end of FY 2020-2021. By the end of October 2021, the figure has reached 7.38 crore. This means the number of demat accounts more than doubled in the last two and a half years.

The story is similar in the case of mutual funds. Recently, AMFI CEO NS Venkatesh stated that the number of unique mutual fund investors has doubled in the last four years. According to him, the number of mutual fund investors rose from 1.19 crore at the end of March 2017 to 2.39 crore as of June-end 2021.

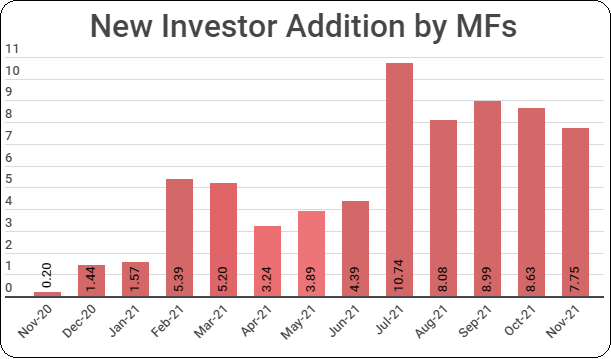

As per the latest AMFI data, the number rose to 2.79 crore by the end of November 2021. Around 8 lakh new investors are joining the MF industry every month since July 2021.

*in lakh

In case of small savings scheme, an average of 34 lakh new accounts were opened each month in FY 2020-2021.

However, the mutual fund and small savings data are not comparable. Unlike small savings, the mutual fund data shared above takes only unique investors into account.