Listen to this article

Indian investors prefer mutual funds over any other investment instruments be it financial products like life insurance and bank FDs or physical assets like gold and real estate to achieve their financial goals, shows the latest investor survey by Cafemutual.

Mutual funds also score over digital assets like cryptocurrencies.

Revealing the findings of a recent survey at Cafemutual Ideas Fest 2022 (CIF 22), Prem Khatri, Founder & CEO, Cafemutual said, “Mutual funds have won the minds, hearts and wallets of investors. They have become the most preferred vehicle to reach various investment goals.”

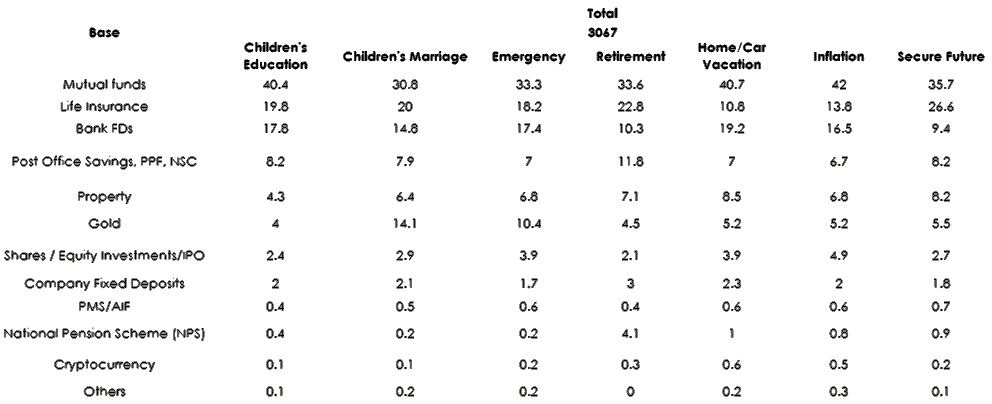

Over 40% investors say that they choose mutual fund to fund their children education, 30% for children marriage, 33% for emergency, 34% for retirement, 41% of home, car and vacation, 42% to beat inflation and 36% for future security.

Here are the key findings: (All result in % terms)

Further, the survey reveals that 76% Indians are aware of both active and passive funds, hinting that MFDs/RIAs should be prepared to talk about passives with investors.

54% investors know about REITs, 27% understand ETFs and 26% are aware of ESG. Further, only 11% of respondents are familiar with international funds. The figures indicate that investors are currently comfortable with traditional categories and educating them about newer categories will be a big task.

Methodology: Cafemutual spoke to 3,067 investors across 11 cities in Nov and Dec 2021. The survey also covers investor categories like women and millennial clients who respectively formed 25% and 40% of the total respondents.

Here is a peep into the key findings of the Cafemutual Survey.