Amid the active vs passive debate, there are many who believe that the future belongs neither to active or passive but to a combination of both, i.e., active + passive.

Data too favours a combined approach. At the recently held Cafemutual Passives Conference 2022, Siddharth Srivastava, Head - ETF Products, Mirae Asset MF shared an interesting analysis on how investors can benefit by investing in a mix of active and passive funds. He used the risk and return data of the past 5 years (as on 29 April, 2022) to make his point.

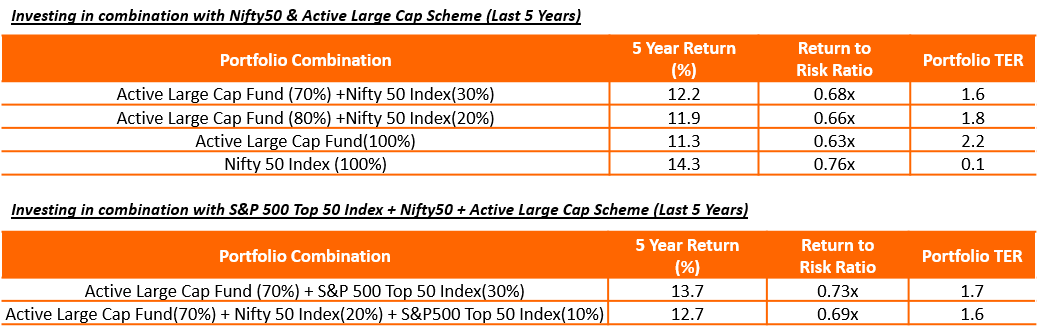

Here's what the analysis showed:

The table shows that though full allocation to Nifty50 would have been a better choice return wise, the high return to risk ratio didn't make it a prudent option. On the other hand, a combination of active + passive would have delivered lower return but they would have come at a more comfortable return to risk ratio.

A combined approach can also bring down the cost. As seen in the above table, a 70% active + 30% index allocation had a lower expense ratio compared to complete allocation to active funds.

How do people across the globe use passive funds?

Citing a Greenwich Associate Research, Srivastava shared some most popular uses of passive funds across the globe. The study showed that 72% of ETF investors use it for tactical adjustments, i.e. to make money out of a certain theme they are bullish on in the short run. 68% use ETFs for making core allocation and 60% find ETFs useful to manage portfolio risks in between rebalancing cycles (by using liquid ETFs or ETFs tracking safe haven asset).

Other popular usage includes portfolio completion and international diversification. "57% use it for portfolio completion. For example, as Nifty Next50 is not well represented in the active side, an investor can use a Nifty Next 50 index fund for portfolio completion. Similarly, if an investor does not have international exposure, he/she can use NASDAQ ETF or a FANG+ ETF for portfolio completion," Srivastava said.

Here is a glimpse of Deborah’s session at CPC 2022. To get access to the entire session, write to us at newsdesk@cafemutual.com.