Listen to this article

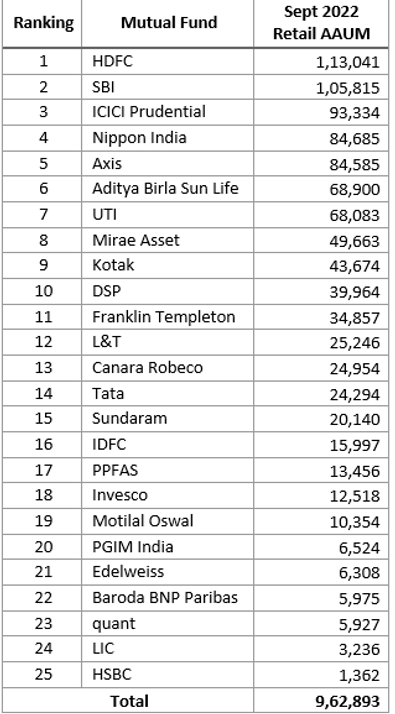

HDFC MF commands the largest share of 12% of the total retail assets. Of the total retail assets of Rs.9.63 lakh crore that the top 25 fund houses manage, HDFC MF accounts for Rs. 1.13 lakh crore, shows an analysis of Sept 2022 AAUM data done by Cafemutual.

With an asset base of Rs.1.06 lakh crore, SBI MF takes the next spot. Notably, these are the only two fund houses managing retail assets of over Rs.1 lakh crore.

ICICI Prudential MF, Nippon India MF and Axis MF manage the next highest share of retail assets in the said order. They individually manage Rs. 93,334 crore, Rs. 84,685 crore and Rs. 84,585 crore.

Collectively, the above five fund houses manage Rs. 4.81 lakh crore or 50% of the total retail assets of the top 25 fund houses (in terms of Sept 2022 quarterly AAUM).

Retaill assets comprise investments across categories - income/debt, growth/equity, balanced, exchange traded funds (gold and others) and fund of fund investing overseas.

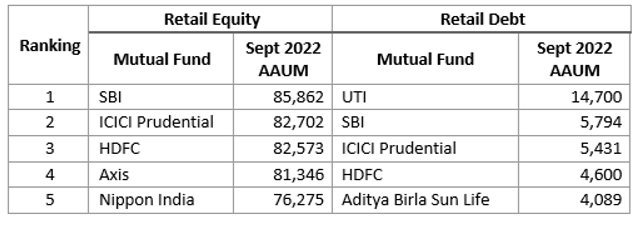

Top 5 - Retail equity and debt

In terms of retail equity AUM, SBI MF tops the list with assets of Rs. 85,862 crore. ICICI Prudential MF and HDFC MF manage the next highest share of Rs. 82,702 crore and Rs. 82,573 crore, respectively. Axis MF (Rs. 81,346 crore) and Nippon India MF (Rs. 76,275 crore) are the next two top fund houses in this segment.

In retail debt assets, UTI MF leads the list with assets of Rs. 14,700 crore.

SBI MF, ICICI Prudential MF and HDFC MF are the next top three fund houses with assets of Rs. 5,794 crore, Rs. 5,431 crore and Rs. 4,600, respectively in retail debt assets.

Aditya Birla Sun Life MF occupies the fifth spot with Rs. 4,089 crore of retail debt assets.