Listen to this article

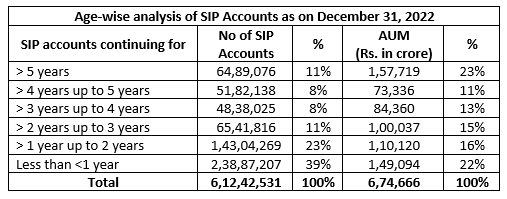

23% or Rs. 1.58 lakh crore of total SIP AUM of Rs. 6.75 lakh crore has remained invested for over 5 years, shows an analysis of industry data.

In terms of SIP accounts, 11% (64.89 lakh) of total SIP accounts of 6.12 crore has stayed active for over 5 years. However, a major chunk (39% or 2.39 crore) of the total accounts were active for less than a year. This simply indicates the rising interest in SIP investing as investors opened a fairly large number of SIP accounts last year.

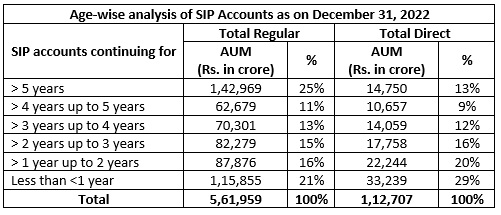

25% of regular AUM stays invested for over 5 years, as against 13% of direct AUM

Of the total SIP AUM, regular plans/distributors contributed a humongous share of 83% or Rs. 5.62 lakh crore whereas, direct plans formed the balance of 17% or Rs. 1.13 lakh crore. These numbers reiterate investors’ comfort in investing through distributors.

The data further reveals that 25% of regular AUM stayed invested for over 5 years, as against only 13% of direct AUM. This hints at distributors’ role in guiding investors to remain patient and disciplined.

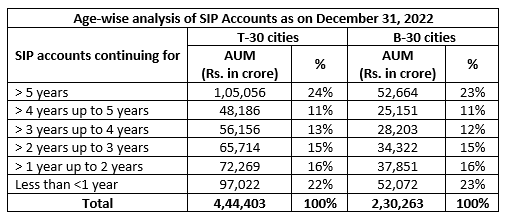

A similar part of T-30 (24%) and B-30 (23%) AUM remains invested for more than 5 years

T-30 cities and B-30 cities individually contributed 66% (Rs. 4.44 lakh crore) and 34% (Rs. 2.30 lakh crore) to the total SIP AUM. Notably, a similar portion of T-30 (24%) and B-30 (23%) assets remained invested for over five years. In fact, the portion of assets held across other time horizons was also more or less the same.