Listen to this article

SBI Pension Funds, LIC Pension Fund and UTI Retirement Solutions are the top three pension funds, shows PFRDA data. These funds collectively manage 93% or Rs. 8.33 lakh crore of industry assets.

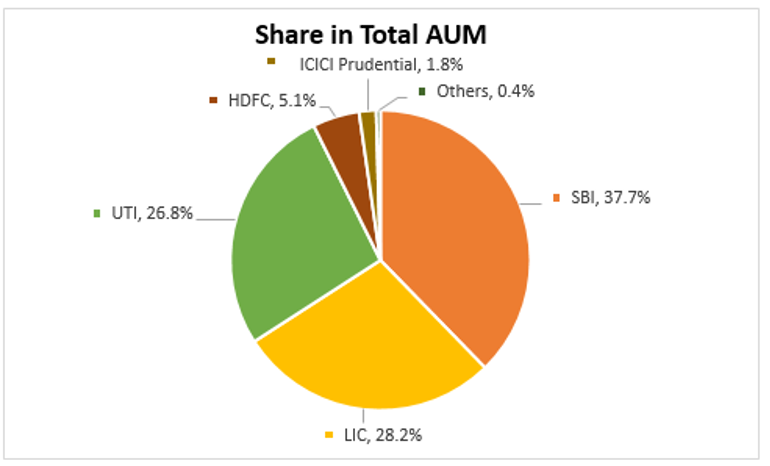

Accounting for 38% (Rs. 3.39 lakh crore), SBI Pension Funds manages the largest chunk of total NPS (National Pension System) and APY (Atal Pension Yojana) assets as on March 31, 2023. Following it are LIC Pension Fund and UTI Retirement Solutions, which manage 28% (Rs. 2.53 lakh crore) and 27% (Rs. 2.41 lakh crore), respectively.

While HDFC Pension Management and ICICI Prudential Pension Fund Management account for 5% (Rs. 45,397 crore) and 2% (Rs. 16,466 crore) each, the remaining five pension funds account for less than a percent.

* AUM as on March 31, 2023 includes APY Fund scheme

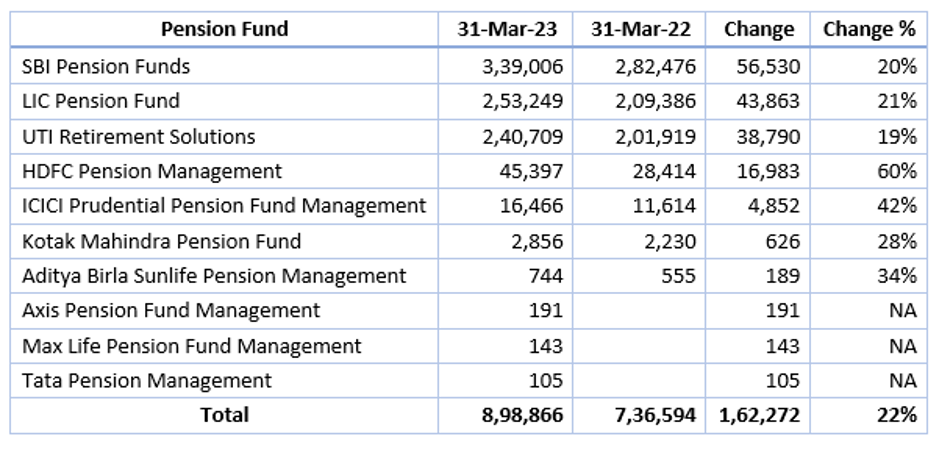

In absolute terms, SBI Pension Funds added Rs. 56,530 crore assets in the last year, the highest among others. LIC Pension Fund and UTI Retirement Solutions recorded the next highest growth of Rs. 43,863 crore and Rs. 38,790 crore, respectively.

However, in percentage terms, HDFC Pension Management, ICICI Prudential Pension Fund Management and Aditya Birla Sunlife Pension Management take the lead. They reported 60%, 42% and 34% growth, respectively.

Overall, the industry assets grew by 22% from Rs. 7.37 lakh crore as on March 31, 2022 to Rs. 8.99 lakh crore as on March 31, 2023.

* Figures in crore

* AUM as on March 31, 2023 includes APY Fund scheme

*** Tata Pension Management, Max Life Pension Fund and Axis Pension Fund recently forayed into the pension space