After close end funds, US and Europe funds, AMCs are trying their luck with fund of fund schemes which invest in multiple asset classes.

AMCs are offering these asset allocation schemes to investors in the wake of volatility and waning interest in equity funds. The primary objective of these funds is to protect investors from any shocks by modulating the asset allocation so as to offer capital appreciation with downside protection

Recently, DSP BlackRock launched its Dynamic Asset Allocation Fund which spreads its assets in debt and equity based on Yield Gap ratio, which is the ratio of debt market yield to equity market yield.

This is how the fund works. 10Y G-Sec yield is used as the proxy for debt market yield, while earnings yield of equity markets is simply the reciprocal of the Nifty Price/Earnings ratio. By evaluating the ratio of these two yields, one can assess whether equity markets are overpriced or underpriced relative to debt markets. The model also considers the Modified Yield Gap ratio, which uses 1Y G-Sec yield in the numerator.

The fund will calculate both these ratios on a daily basis. If the difference between the two ratios is greater than 0.05, the fund will use yield gap ratio and in case the difference is less than 0.05, the fund will use modified yield gap ratio.

“Our investors are saying that if fund managers are so intelligent then why they can’t help us in getting out of equity at the right time. We all are good at telling people when to enter market. But it is very tough to tell people when to get exit equities. We felt that the active approach of the fund with a built-in advice model will resonate well with investors. A large chunk of advisors and investors are looking for this kind of fund,” said Ajit Menon, EVP and Head of Sales & Marketing, DSP BlackRock Mutual Fund in an earlier interview with Cafemutual.

Three more fund houses (Principal, Reliance and Motilal Oswal) are planning to launch similar funds, though with a broader investment mandate. One distinctive feature of the asset allocation funds which Motilal Oswal and Reliance are planning to launch is that these funds will also invest in overseas fund of funds. So far, existing asset allocation funds in the industry have a mandate to invest only in debt, equity (domestic), and gold.

Motital Oswal’s fund is called MOSt Asset Allocation Fund - Series 1. The scheme will come with two plans - equal weight plan and dynamic plan. This fund will invest across three asset classes – equity, debt and gold.

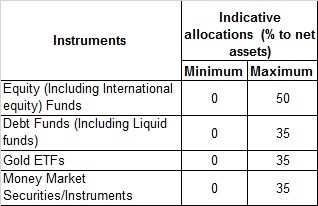

Equal weight plan

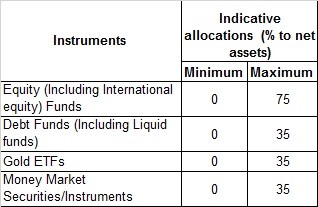

Dynamic Plan

In addition, the fund will also provide geographic diversification by invest in domestic overseas fund of funds. The scheme will follow a customized benchmark which consists of 40% of CNX 100 Index + 40% of Crisil Composite Bond Fund Index +20% of prices of gold.

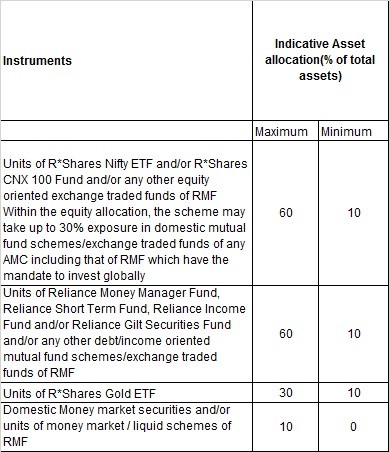

Reliance Mutual Fund has also approached SEBI to launch a fund of fund scheme which will invest in equity, debt and gold funds. The fund will follow a customized benchmark of 40% of CNX 100 Index + 40% of Crisil Composite Bond Fund Index +20% of prices of gold.

Similarly, Principal Mutual Fund has filed an offer document with SEBI to launch Principal Asset Allocation Fund of Funds. This scheme will come with five plans – conservative, moderately conservative, moderate, moderately aggressive and aggressive.

Such funds are not new to the market. AMCs have launched many funds which shift asset allocation based on certain back tested models like PE, arbitrage and derivative opportunities. One advantage of such funds is that investors don’t need to worry about the entry and exit points while investing as the asset allocation is handled by fund managers.

On the contrary, critics point out that the performance of such funds can be bad if equity markets are down. Some suggest that it is better to put money in debt and equity funds separately.

Asset allocation funds work on two models – some funds directly invest in stocks while others invest in existing funds (through a fund of fund structure). One flipside of a fund of fund structure is that it could come with higher expense ratio because the fund of fund invests in another fund which also has its own expense ratio.

“Some asset allocation funds have worked well. Franklin Templeton’s Dynamic PE fund is one example which had performed wonderfully. DSP BlackRock’s fund also looks promising,” said Vinod Jain of Jain Investments.

However, he cautions that mixing too many asset classes in one fund may not work.

“It has become difficult to sell a pure vanilla diversified fund. There has been a flurry of new fund offers with divergent investment mandates (close end, US, Europe, FMPs, capital protection funds). AMCs have to come out with new strategies to woo investors,” said a Mumbai based distributor on the condition of anonymity.