Listen to this article

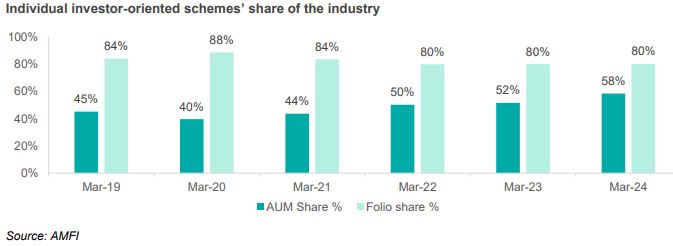

AMFI data shows that the share of assets of individual investors with respect to the total MF assets now stands at 58% in March 2024.

Over the last five years, the proportion of individual assets to the overall AUM increased from 40% in March 2020 to 58% in March 2024.

Let us look at the table to know more.

Further, the data shows that individual investors showed a preference for categories such as equity, hybrid and solution-oriented schemes.

Here are other key highlights.

Equity funds

Equity schemes saw a significant 55% rise in assets over the last one year. The equity AUM grew to Rs. 23.50 lakh crore in March 2024.

Moreover, there were net inflows of Rs. 1.84 lakh crore in FY 2024, up from Rs. 1.70 lakh crore in FY 2023.

Flexi cap category was the largest fund category with assets of over Rs 3.50 lakh crore as of March 2024, followed by large cap funds with Rs 3.14 lakh crore assets. In terms of percentage growth, multi cap fund category saw the highest growth of 85% in fiscal 2024, followed by small cap funds at 82%.

Hybrid funds

The AUM of hybrid funds crossed over Rs. 7 lakh crore in FY 2024.

Meanwhile, investors also actively adopted other hybrid categories with multi-asset allocation, equity savings fund and dynamic asset allocation/balanced advantage fund categories seeing growth of 153% (highest category growth within the hybrid category), 85% and 30% respectively.

Within the hybrid funds category, dynamic asset allocation/balanced advantage funds emerged as the largest category with assets of nearly Rs 2.50 lakh crore in March 2024, followed by balanced hybrid/aggressive funds with assets of Rs 1.97 lakh crore.

Debt funds

Debt funds saw moderate growth of 7%, reaching total assets of close to Rs. 13 lakh crore in FY 2024.

Among debt funds, money market and liquid funds witnessed the highest absolute increase in assets, with money market funds growth of Rs. 40,000 crore and liquid funds growth of Rs. 31,000 crore as on March 2024.

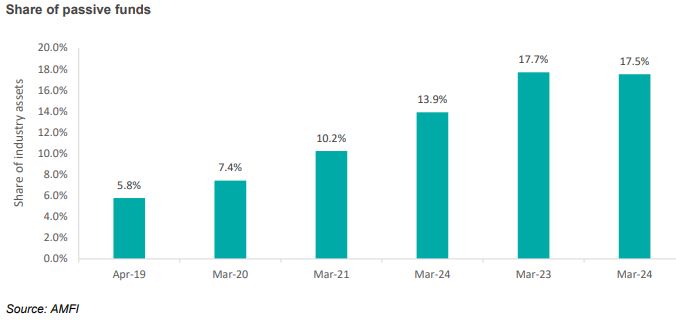

Passives

Passive funds continued to see growth in assets. The share of passive AUM to the total AUM now stands at 18% in March 2024. Five years back, this share was just 7.4%.

ETFs including equity, debt and gold ETFs saw maximum growth in assets thanks to institutional investors.

SIP

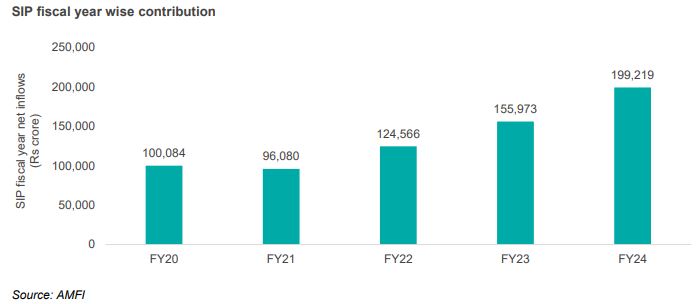

SIPs maintained their upward trend, with monthly net inflows reaching over Rs.19,000 crore. The total net inflows through SIPs amounted to nearly Rs. 2 lakh crore in FY 2024, 29% increase compared to Rs. 1.55 lakh crore in FY 2023.

SIP assets now make up 20% of the mutual fund industry's total assets, standing at Rs. 10.71 lakh crore as on March 2024.