Advisors are likely to promote growth option in debt funds as they feel there is no incentive to invest in debt funds through dividend payout option.

With the proposed revision in computation of Dividend Distribution Tax (DDT), the dividend payout option in debt mutual funds has certainly become less attractive.

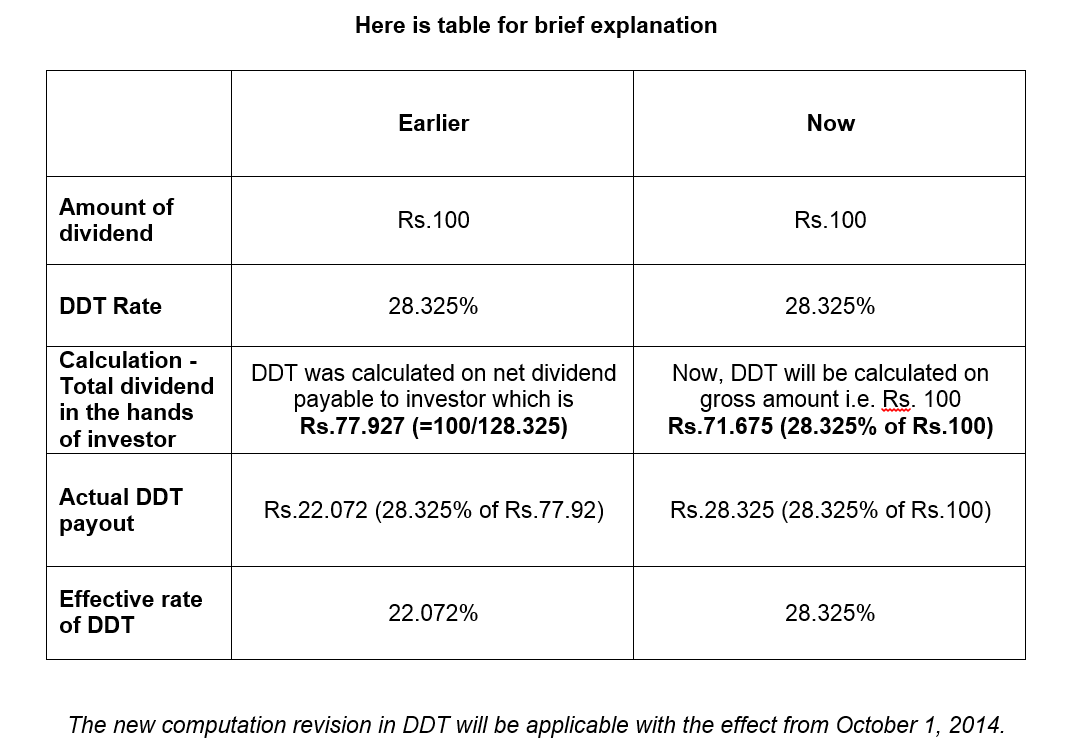

Fund houses pay DDT for dividend income distributed by debt funds, which is tax free in the hands of investors. Debt funds currently pay DDT of 25%+ 10% surcharge + 3% cess on net basis when they distribute income to resident individuals. Calculation on net basis reduces the actual pay out to 22%.

Finance

minister has retained the DDT rate; however, the computation process is

proposed to be changed. Now, the fund houses are required to pay DDT on gross

basis which will hike the actual DDT payout.

Fund houses and distributors are likely to promote growth plans of debt funds going forward after the announcement on change in calculation pattern of dividend distribution tax (DDT) on debt funds.

Nikhil Kothari of Etica Wealth Management is of the view that dividend payout option doesn’t offer any incentive to investors. “With the end of arbitrage opportunity, dividend payout option has become less attractive. There is no point of opting for dividend payout option for an individual falling under 10% or 20% tax bracket. Similarly, it may not create much difference for individual falling under 30% tax bracket. It’s better to stick with growth option,” said Nikhil.

“It doesn’t make sense to opt for dividend payout option for individual irrespective of his/her tax bracket. Investors should simply go with growth option. Firstly, they will have indexation benefit if they stick with their fund for over three years. Also, they will be taxed on marginal rate of taxation in case of redemption within three years just like bank deposit. In any case, they will be on better side compared to dividend payout option,” said Suresh Sadagopan of Ladder7 Financial Advisories.

Vikas Sachdeva, Chief Executive Officer, Edelweiss Mutual Fund seconds the view and advises investors to opt for growth option at this juncture. “Investors should now focus on growth plans to take advantage of long term capital gains. Also, investors can use systematic withdrawal plan (SWP) which are more tax efficient,” he said.

“Since the arbitrage is gone, dividend payout option has become less attractive. An alternative is to opt for SWP if your clients need a regular income. SWPs are more tax efficient as compared to bank fixed deposits. Investors belonging to the highest tax slab can enjoy indexation benefit if they hold for over three years,” says DP Singh, Executive Director & Chief Marketing Officer (Domestic Business), SBI Mutual Fund.

The FY 2013-14 has been stellar for debt funds with the

industry clocking inflows of nearly Rs. 5.94 lakh crore. AMFI data shows that

the debt funds constitute nearly 72% of industry AUM of Rs. 8.25 lakh crore as

on March 31, 2014.