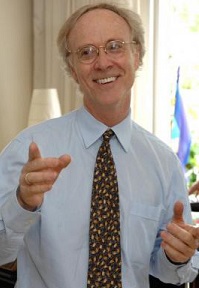

Father of life planning, George Kinder talks to Cafemutual about the concept of life planning, its need and benefits for financial advisors.

How did you conceive the concept of life

planning?

How did you conceive the concept of life

planning?

I never thought of doing financial planning any other way. Every financial planning engagement is supposed to start with ‘getting to know your client.’ How else can you get to know them than by doing “life planning?” How can you possibly get to know them and their concerns and passions and approaches to life by focusing on the numbers, the finances? When you leave the client’s life out of the conversation in a real and a deep way, you end up doing terrible work as a financial advisor, contributing to the already low level of reputation and trust in the industry.

What is the major difference between financial planning and life planning?

None. Life Planning is financial planning done right. Another way to think of it is that Life Planning is the initial stage of the financial planning engagement. You can’t begin to do financial planning until you’ve done the Life Planning piece of it.

How do life planning and financial planning work together?

Life Planning first, then financial planning. Life Planning is what you need to define the parameters and goals of a financial planning engagement.

What are the key benefits to financial advisers who use the life planning approach?

There are many advantages, both from a business standpoint and a personal standpoint. See my list below:

· Most efficient way to do financial Planning - by far! If you don’t know a client’s most important, most meaningful and profound goals what are you planning for? Your aim will be way off. Life Planning is the only way to get a clear picture of where the client really wants to go in life. Only then does a financial plan make sense.

- Clients for life. Why would a client leave you if you deliver them the life that they want?

- Greater retention, fewer sales if client’s don’t leave you

- Higher percentage of assets under management AUM. Typically, clients give Life Planners 100% of their assets to manage, whereas advisors in banks typically get 16%, brokers typically get 35-45%.

- Advisor income stream automatic rather than constantly selling. Huge cost savings when each client is so much more productive for a firm.

- Referrals after first meetings. Often referrals don’t come for years, and depend on investment returns. But here, the added value is delivering the client the life that they want. And that’s what the client truly does want, along with a sensible, secure and integrity filled financial approach. Give them both, and you’ll get referrals after the first meeting, the difference with old-style, sales-oriented advisors is that great.

- 3-5 times the sale value of commission firms. Fee-only firms typically sell for 3-4 times the value of commission based firms. That’s due to the trust in the advisor and trust in the process that then delivers dependable recurring revenue to the firm that can be monetized at the sale of the firm. Life Planning has the highest quotients of trust of all financial methodologies, and should provide an additional multiple of sale value.

- Energized client, re-energized adviser. The process is thrilling for both the client and the advisor.

- Happiness and Vigor. For both client and advisor. One of our tenets is that you can’t do Life Planning for others until you’ve been life planned yourself, until you’re living your Life Plan. Otherwise the client will see inauthenticity all over you, and you’ll come across as the slick sales guys of the past.

What kind of challenges you faced in communicating the concept of life planning among advisor? How was the response from professionals in initial years?

There are Kinder Institute trained Life Planners in 25 countries – it is a global phenomenon. But in every culture, because the ‘old model’ is SALES, there is resistance to having genuine conversations with clients. It’s never been done before, as obvious as it is. Often a new culture will say, “Well you can do that in America, but you can’t do it here.” Completely forgetting that America has both blue and red states, both an urbane and a country culture, a left and a right. Truth is that everyone wants freedom in their lives, and wants their finances to aim directly at the freedom that they aspire to. In the old days sales guys put a figure to freedom that had nothing to do with a genuine conversation with their clients, but got the clients to buy ridiculously expensive or risky products as a consequence. Life Planners find out what the clients really want, and map out the path to accomplish it. Everybody loves it. Why wouldn’t they!

How did you popularize it in the US?

My book, The Seven Stages of Money Maturity made it popular both amongst consumers and advisors. We worked through all the financial planner networks then to get traction in the advisory world.

How do you seek to popularize this concept in India?

My new book, Life Planning for You, will be published and available in a UK version in February and a US version in April. We’ll look to have Kindle version for inexpensive downloads all over the world. We also will be launching both a consumer and an advisor web version of Life Planning to support consumers who want to do it themselves and advisors who want a systematic and organized approach that collates results by advisor and by client. We hope to bring our EVOKE® five-day signature Life Planning training for advisors to India in 2014, and are engaged in plans to make that happen. Network FP has been brilliant and very supportive in our efforts, and India has a special place in our hearts.

How could a financial adviser in India pursue training on life planning?

Stay in touch with Kinder Institute and with Network FP. Watch our websites. If you would like to move in a hurry, consider taking the 5 day trainings we offer in the US and the UK in 2014. We also have begun to give two-day Seven Stages of Money Maturity trainings in India.