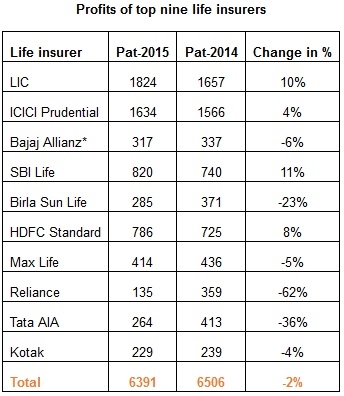

The top nine life insurers have recorded a 2% decline in their Profit after Tax (PAT) in FY14-15. The combined net profit of the nine insurers stood at Rs. 6,391 crore in FY 2014-15 as against Rs.6,506 crore in the corresponding period last year.

The decline in profitability was primarily due to muted sales of traditional policies & pension products and lower persistency ratio, said experts. Among the top nine Insurers in terms of their AAUM, five life insurers saw a decrease in their profitability.

Typically, profitability is a function of underwriting efficiencies and building good renewals. Higher persistency and more efficient underwriting can lead to higher profitability.

State owned LIC has overtaken ICICI Prudential as the most profitable life insurer for the second consecutive year. LIC’s net profit increased from Rs.1,657 crore in FY13-14 to Rs. Rs.1,824 crore in FY14-15, clocking a 10% growth. A Mumbai based financial advisor attributes this growth to strong agency penetration and good track record of LIC. According to him, LIC has opened some new branches in small cities which helped it collect good premium from these areas.

ICICI Prudential’s PAT for fiscal 2014-15 stood at Rs.1,634 crore, up 4% from last year at Rs. 1,566 crore. ICICI Prudential Life had the distinction of being the most profitable insurer in FY 2011-12 and FY 2012-13.

HDFC Standard Life recorded a growth of 8% by clocking a net profit of Rs.786 crore as against a net profit of Rs.725 crore in FY 2013-14. Similarly, SBI posted a growth of 11% in PAT at Rs. 820 crore against Rs.740 crore in its preceding fiscal.

Other life insurers like Birla Sun Life, Max Life, Reliance Life, Tata AIA and Kotak have witnessed a decline in their profit margins. Reliance Life’s PAT slipped from Rs.359 crore in FY 2013-14 to Rs.135 crore in FY 2014-15, a decline of 62%. Similarly, Max Life’s profit declined from Rs.436 crore in FY 2013-14 to Rs.414 crore in FY 2014-15. Kotak Life’s PAT too declined from Rs. 239crore to Rs.229 crore in FY-2014-15.

Source: Cafemutual study

*We have put PAT figure of first three quarters of Bajaj Allianz. Also, we have excluded it from total.

The profit figures of Bajaj Allianz was not available till the time of writing this piece. However, the company has recorded a modest decline of 6% in the first nine of FY 2014-15. Its PAT stood at Rs.317 crore as on December 2014 as against Rs.337 crore as on December 2013.