First year premium of public sector insurer LIC witnessed positive growth of 13 per cent compared to negative growth of 11 per cent by 22 private insurers

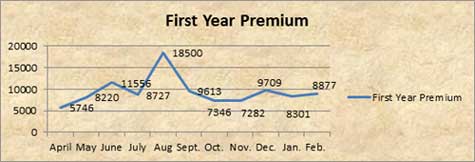

Mumbai: The first year premium of life insurance industry grew only by 4 per cent in February 2011. Life insurers collected new business of Rs. 8,877 crore in February 2011 as compared Rs. 8,544 crore in February 2010, according to monthly sales data by IRDA.

|

Life Insurers |

Feb. 2011 |

Feb. 2010 |

Growth % |

|

Private |

2891 |

3243 |

-11 |

|

LIC |

5986 |

5301 |

13 |

|

Total |

8877 |

8544 |

|

The first year premium of 22 private life insurers grew 4 per cent to Rs. 30,756 crore in April-February 2011. However the first year premium of Life insurance Corporation advanced 34 per cent to Rs. 73,121 crore for the same period.

Source: IRDA

In February 2011 LIC managed to collect Rs. 5,986 crore by selling new policies, up by 12 per cent as compared to Rs. 5300 crore for the same period last year.

Among the private players SBI life insurance collected the largest first year premium of Rs. 570 crore followed by ICICI Prudential and HDFC Standard Life at Rs. 513 crore and Rs. 323 crore respectively.