|

Many a time, investors would focus on a mutual fund's performance when deciding on what fund to buy. However, while that is an important factor to consider, we believe it is also important for investors to examine other factors, including those which indicate an investment's risk level. In this article, we explain why the Sharpe ratio and the Risk-return ratio are good proxies to do just that.

What Is A Sharpe Ratio?

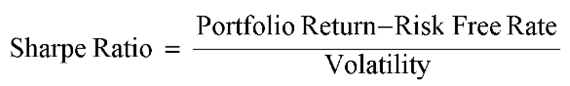

The Sharpe Ratio measures an investment's excess return per unit of risk. The excess return is calculated by finding the investment's return in excess of that from a risk-free asset. The risk free asset in India is the 10 year government bond. This ‘excess return' is then divided by the investment's volatility level, which can be measured by the standard deviation of the returns.

The Higher The Shape Ratio, The Better The Portfolio's Performance

The Sharpe Ratio can be used to compare the performance of a portfolio or fund manager, relative to their peers. When the Sharpe ratio is used to rank the performance of a fund manager, it indicates the excess return that the fund manager can deliver to investors per unit of risk that the fund manager is taking.

Hence, the higher the Sharpe ratio, the better the investment's performance. However, investors should compare the Sharpe ratio of mutual funds which have a similar investment objective, and invest in the same sector. For example, from the numerous diversified equity funds distributed on our platform, investors can compare the Sharpe ratio of these funds to find which one can provide better risk-adjusted returns.

What is a Risk-return Ratio?

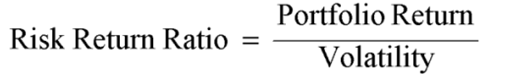

The Risk Return ratio is a simpler version of the Sharpe ratio. It measures the return per unit of risk, but does not take into account the excess return from an investment's return above that of a risk-free instrument. Therefore, the Risk-return ratio takes the portfolio's return, and its volatility (standard deviation) to measure the investment's risk level.

Generally speaking, the Risk-return ratio is similar to the Sharpe ratio. Both of them are used to measure the return of a mutual fund for every unit of risk taken. Investors can compare the two ratios for the mutual funds which are invested in the same asset class or sector. When a mutual fund's Shape ratio and Risk Return ratio are higher than those of its peers, this means that the fund gives a better return for a given unit of risk.

Conclusion

The Sharpe Ratio and Risk Return Ratio are measures that are commonly used for comparing the performance of mutual funds or portfolios, and the way that the fund manager manages risk and performance, as the ratios provide an indication of the level of risk borne by the fund manager in the process of running the fund or portfolio. We believe that a good fund manager should be able to deliver good returns, but must also manage the volatility of the fund effectively. In other words, a good fund should have a better-than-average Sharpe ratio or Risk Return ratio.

|