When markets are volatile, your relationship with clients determines the longevity of your business. The challenge is to perform exceptionally well and keep your clients in confidence. So how are successful advisors different from others?

A whitepaper on ‘Marketing tactics of elite advisors’ gives insights on what activities elite advisors are currently undertaking to attract, retain and enhance their relationships with wealth clients. The report published by The OECHSLI institute and Cetera Financial Group gives practical and actionable insights and techniques that successful advisors are leveraging effectively.

The study comprises responses from 352 financial professionals representing a variety of business models, affiliations, ages, experience levels and production levels in US. The data was collected through an online survey. Although the survey was carried in US, it has relevance for IFAs in India too.

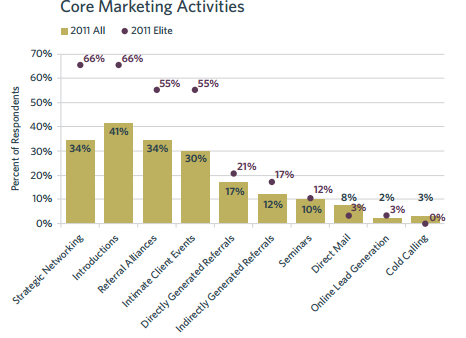

So how are elite advisors able to effectively target and acquire wealthy clients? The survey asked respondents to choose which marketing technique was used as a core marketing activity to acquire clients. Here are the results:

Of the 10 techniques, 66% of elite advisors connect with clients through ‘strategic networking’ as compared to other IFAs. Strategic networking means getting involved in organizations within a particular community of professionals, say IT professionals, to attract more clients.

66% of elite advisors also prefer being personally introduced to a prospect by a client or friend while 55% of them rely on ‘referral alliances’, i.e. developing working relationships with estate planners or attorneys where referrals are both given and received. Another set of advisors believe intimate client events help them increasing their client base (55%).

Here are few key takeaways for advisors from the report:

- Make sure you are focussing on other trusted partners (e.g., attorneys, estate planners) with whom your clients work. Approach those professionals who share multiple clients with you. Your shared interest provides a strong foundation for future referrals. Make it a goal to turn three or four of these trusted partners into healthy referral alliances.

- Developing relationships may take consistent effort over time but through creative touch-points throughout the year—inviting them to lunch or discussing them about taxes or sending a gift basket during the holidays—you can stay in touch and make the relationships personal as well as professional.

- Whenever you receive a lead from a client, don’t simply ask for a referral—ask for a personal introduction. Your goal should always be to meet the individual face-to-face.

- Focus on arming your existing clients with the words to refer you. Many satisfied clients who would otherwise be happy to refer you will hesitate simply because they don’t have the language to convey your value proposition and what differentiates your firm. Ensure it is prominent in your marketing materials and your conversations.

- Commit to spending more time out of the office in social settings where the affluent in your community are likely to frequent (e.g., country or athletic clubs, fund-raisers, arts events). Networking and prospecting in a relaxed environment can pay big dividends.

- Look for ways to heighten the visibility of yourself and your firm. Sponsor charitable or community events. You can also start writing a blog or columns in newspapers. This will give current clients a sense of pride in working with you which will directly relate to the referrals.

- When marketing your services to the affluent, avoid low impact marketing such as seminars, online lead generation, direct mail and cold calling.