Most mutual fund investors are happy with their distributors. The latest Final Mile study, commissioned by Foundation of Independent Financial Advisors (FIFA), claims that that eight out of 10 mutual fund investors are satisfied with their distributors even if their funds underperform.

Of the investors who witnessed underperformance of their mutual fund schemes, 78% are satisfied with the services of their distributors.

The report attributes this to handholding by distributors across market cycles. “The distributor offers critical handholding services to investors during periods of poor performance and market uncertainty to assuage the dissonance and help investors persist with their wealth journeys and long-term financial plans,” the report said.

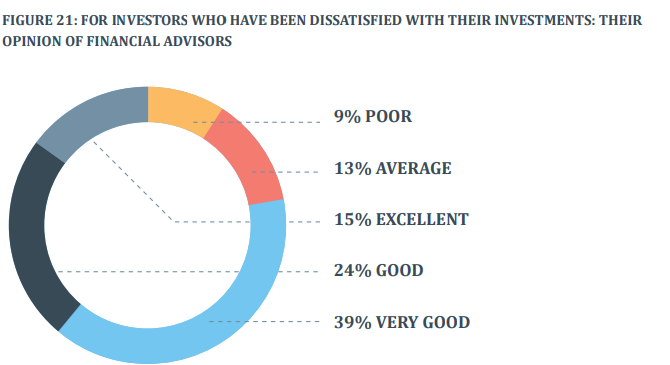

The report further claims that 15% of these 78% investors rated the service of their distributors as excellent; 39% and 24% marked it very good and good, respectively.

The report shows that poor performance of funds is the key reason for dissatisfaction among investors and not the services of distributors. The report states: “From investor’s point of view, advice is implicit in the investor-advisor/distributor relationship. Moreover, this relationship is primarily based on ‘affective (emotional) trust’ and is not based on cognitive trust. This explains why, in our study, when outcomes were not in line with investor expectations, investors were disappointed in the product or asset class rather than with their advisor/distributor.”

Another key finding of the study is that investors who use the services of mutual fund distributors have a better knowledge of mutual funds.

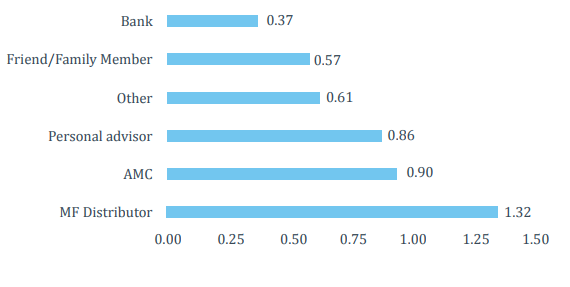

“Participants who use distributors to support their investments scored highest on the four different ‘scenario-and-product’ matching questions in our quantitative study, as compared to mutual fund investors who used other distribution channels. On average, participants who use a distributor in real life scored 1.32 questions correct out of 4; no other channel scored more than 0.9 correct answers. There seems to be better absorption of mutual fund knowledge by investors using a distributor, indicating a higher quality of interaction from an investor awareness and knowledge perspective,” the report states.