Of late, debt funds have delivered returns lower than fixed deposits and experts anticipate a similar trend this year. This clearly calls for the need of exploring alternative investment avenues that can generate better returns.

With this in the background, Cafemutual curated an exclusive webinar on ‘Emerging Fixed Income Products’ and hosted Saurav Ghosh who has co-founded Jiraaf, a fintech start-up. In conversation with Nishant Patnaik, Associate Editor, Cafemutual, Saurav spoke about the opportunities available in this space.

Here are some of the pertinent questions that were taken up.

Why emerging fixed income products? What do they comprise?

Equity requires a long term investment horizon and is not the best choice for investors wanting to invest for up to three years. Such investors may understandably opt for fixed income products. However, given the modest returns, traditional fixed income products are not a great choice either. In such a scenario, you can help your clients to bridge the gap between volatile equities and low-yielding fixed deposits through emerging fixed income products.

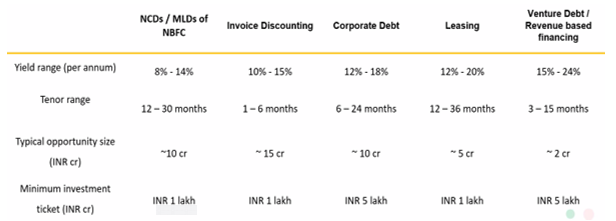

Sourav classifies these products into five categories. Here are the details.

How do these products function?

Above mentioned products are structured to meet the working capital requirements of companies including large organisations and start-ups. They are designed in a way where individual investors can participate through a digital platform.

In this set-up, investor is the lender and corporate the borrower. Investors are aware to whom the money is being lent and hence, such products offer utmost transparency.

These products generate non-market linked and predictable returns. The returns earned under NCDs (Non-convertible debentures)/MLDs (Market Linked Debentures) of NBFCs, invoice discounting, corporate debt and venture debt/revenue head financing are taxable as interest income under ‘Income from Other Sources’ at the applicable tax slab of investors whereas, in the case of leasing, net income (post deduction of tax at fund level) gets credited to investors’ account and is tax-free in the hands of investors.

Are emerging fixed income products regulated?

Currently, no regulations exist for a fintech digital platform, and hence Jiraaf is not subject to any regulations as such. However, regulations do exist at the product level and Jiraaf ensures complete compliance.

RBI regulations apply to invoice discounting and investors receive the requisite agreement. NCDs/MLDs of NBFC, corporate debt and venture debt/revenue based financing involve private placement of debentures, which reflect in investors’ demat account. Depending on the product type and issue type, some of these debentures may be listed.

Lastly, leasing requires the formation of an LLP (Limited Liability Partnership)/SPV (Special Purpose Vehicle) and is subject to the Companies Act. In this case, investors become partners/shareholders and are given the relevant documents. The LLP distributes post-tax returns to its investors thereby making it tax-free in their hands.

For NRI Investors

NRI investors can invest in invoice discounting and leasing through their NRO account. In the case of the other three products, NRIs can participate only if debentures are listed.

What are the risks involved?

Emerging fixed income products primarily include credit risk, liquidity risk and interest rate risk.

- Credit risk - There is always a probability of borrowers defaulting repayment. However, Jiraaf’s stringent covenants and credit & risk assessment framework act as a mitigant here. Besides, most of the assets are collateral backed. Additionally, diversification also helps to reduce this risk.

- Liquidity risk - Emerging fixed income products are exotic products and currently have no secondary market. Investors have to stay invested until the product maturity.

- Interest rate risk - An increase in interest rate can cause a dip in real returns.

How can MFDs empanel themselves with Jiraaf? What are the revenue opportunities here?

As of today, Jiraaf manages assets worth Rs. 130 crore. It has 4,500 investors and close to 35 channel partners.

MFDs desirous of empanelling with Jiraaf can write at support@jiraaf.com or visit their website https://www.jiraaf.com/ for more details.

Product maturity as well product type differs and hence there is no standard commission structure. However, these products have the potential of generating commission as high as 3% in certain cases.

Enjoyed reading the key highlights? Watch the entire webinar here.