Listen to this article

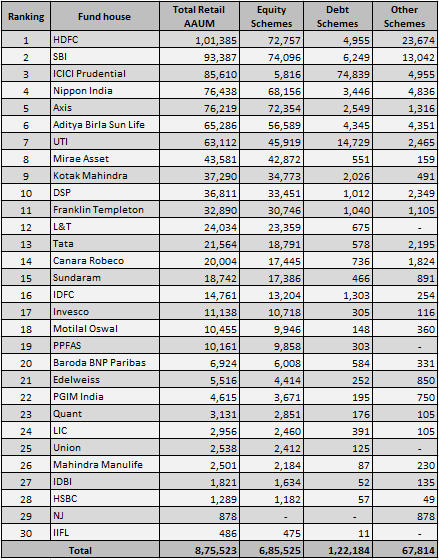

An analysis of industry data done by Cafemutual shows HDFC MF, SBI MF and ICICI Prudential MF are the most popular fund houses among retail investors. They have the highest retail AUM share in the industry and collectively manage assets of Rs. 2.80 lakh crore.

HDFC MF, SBI MF and ICICI Prudential MF manage Rs. 1.01 lakh crore, Rs. 93,387 crore and Rs. 85,610 crore, respectively.

Nippon India MF and Axis MF are the next popular fund houses with Rs. 76,438 crore and Rs. 76,219 crore of retail assets.

Aditya Birla Sun Life MF (Rs. 65,286 crore), UTI MF (Rs. 63,112 crore), Mirae Asset MF (Rs. 43,581 crore), Kotak Mahindra MF (Rs. 37,290 crore) and DSP MF (Rs. 36,811 crore) enjoy the next highest share of retail assets.

Here is the ranking of the top 30 fund houses basis their retail AAUM. Figures mentioned are in crore.

The top 30 fund houses jointly manage Rs. 8.76 lakh crore of retail assets. Of these 78% or Rs. 6.86 lakh crore are equity assets, 14% or Rs. 1.22 lakh crore are in debt funds and 8% or Rs, 67,814 crore are held in other schemes i.e. balanced funds, exchange traded funds and fund of funds.

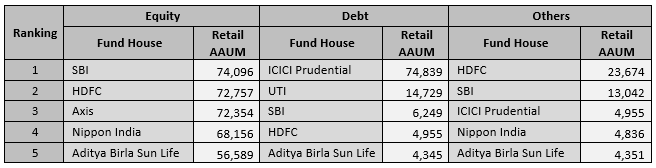

Scheme-wise ranking

SBI MF tops the retail equity AAUM category and ICICI Prudential MF leads the debt AAUM category. In the case of other schemes, HDFC MF takes the lead.

Here are the top five fund houses under each category. Figures mentioned are in crore.