Listen to this article

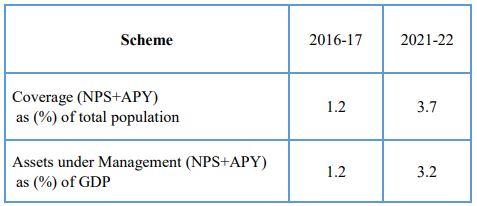

The penetration of National Pension Scheme (NPS) and Atal Pension Yojana (APY) has improved significantly in the last 5 years, rising from 1.2% in 2016-2017 to 3.7% in 2021-2022. This is a result of a multi-fold growth in the number of subscribers during the period. The AUM (as % of GDP) has also multiplied from 1.2% to 3.2%, shows an IRDAI report.

"The pension-sector, though started late, is progressing much faster than the nominal growth of the economy as well as population. Impressive as these numbers are, they pale in comparison with development in a number of other countries. For example, almost everybody in OECD countries have access to pension in some form or other, which doubles as old-age social security benefits," IRDAI said in a report.

Progress of Pension Sector (NPS & APY):

However, it is not like only 4% of the population saves for retirement. In India, term deposits, ULIPs, mutual funds and even real estate are more popular long-term investment options.

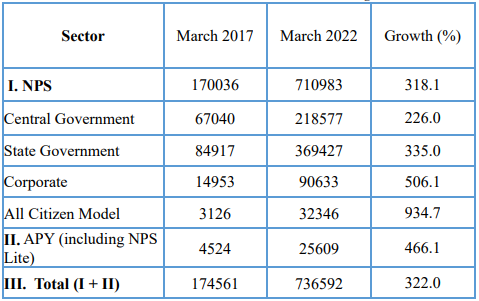

Multi-fold growth in AUM

The assets under management (AUM) of NPS schemes have grown 4-folds in the last 5 years. These schemes were managing assets worth Rs. 7.10 lakh crore as of March 2022 as against Rs. 1.70 lakh crore in March 2017, shows IRDAI data.

Scheme category-wise AUM in Rs crore

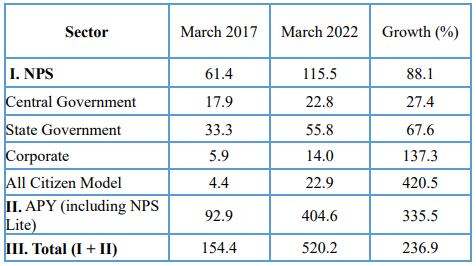

The growth in AUM has coincided with the surge in number of subscribers. During the 5-year period, number of NPS subscribers has grown 88% to 1.15 crore from 61 lakh. Notably, the growth has mostly been driven by state government employees and self-made accounts (non-government and non-corporate). While the count of state government employees has gone by 22.5 lakh, self-made accounts have risen by 18.5 lakh.

Pension Sector has Expanded Rapidly (Rise in number of subscribers):

Numbers are in lakh

The report stated that only 24% of the self-made NPS accounts in the last 5 years belonged to females.