Listen to this article

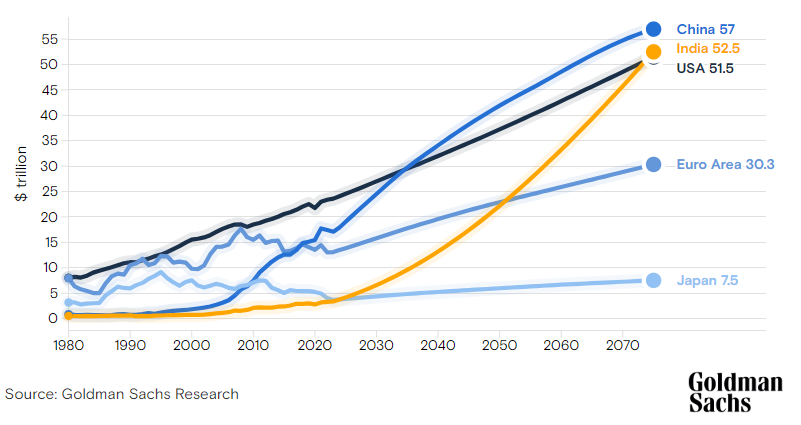

Goldman Sachs Research forecasted India to be the second-largest economy by 2075. Notably, it is likely to overtake the US and report a GDP of 52.5 trillion dollars.

India currently has the world’s largest population and one of the best working population to children and elderly ratio. The country’s dependency ratio will also be one of the lowest over the next two decades.

On these demographics, Santanu Sengupta, Goldman Sachs Research’s India economist remarked, “So that really is the window for India to get it right in terms of setting up manufacturing capacity, continuing to grow services, continuing the growth of infrastructure.”

However, the large labour force could also pose a challenge if the labour participation rate does not rise. The labour force participation rate has gone down over the last 15 years and the participation of women is significantly lower than men.

India can overcome this challenge by creating work opportunities while providing training and upskilling to labour force. A rise in labour force participation can increase the growth potential further.

In addition to favourable demographics, innovation will also play a key role. Likewise, capital investment will also be a significant growth driver. “On this front, the government has done the heavy-lifting in the recent past. But given healthy balance sheets of private corporates and banks in India, we believe that the conditions are conducive for a private sector capex cycle”, said Santanu.

He added, “There’s a lot of infrastructure creation that is going on now, primarily led by the government’s focus on setting up infrastructure in terms of roads, railways and so forth. We believe this is also the appropriate time for the private sector to scale up on creating capacities in both manufacturing and services which has the potential of creating jobs and absorbing the large labour force.”

Santanu also spoke about net exports and commodity prices as other key factors to decode the Indian economy.

Until now, India’s growth is mainly domestic-demand-driven and its current account remains in deficit. Also, since India imports most of its commodities, a global rise in commodity prices results in macro imbalances. However, in recent times the macro environment is strengthening with the rise in service exports and inflation targeting that have somewhat helped.