Listen to this article

An analysis of AMFI data reveals that the inclination of individual investors toward debt funds has been increasing over the last one year.

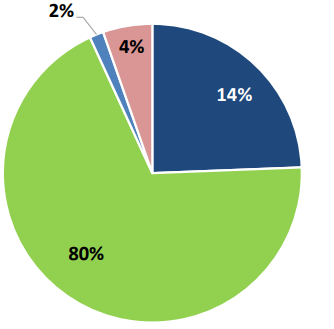

Of the total individual assets of Rs.25 lakh crore, Rs.3.70 lakh crore was invested in fixed income funds other than liquid and overnight funds as on June 2023. This indicates that debt funds account for 14% of the total individual assets. In the corresponding period last year, individual investors held Rs.2.92 lakh crore in debt funds.

Goa MFD Hari Kamath of HGK Investment Avenue feels that many investors have rebalanced their investment portfolio. “Over the last one year, many investors have booked profits and shifted money in debt funds to maintain asset allocation,” he said.

Mumbai RIA Suresh Sadagopan of Ladder7 Financial Advisories points out that change in taxation encouraged investors to stay invested. “ From 1 April 2023, the government has introduced new taxation norms in which it has done away with the indexation benefit of debt funds. Many investors who invested before April 1 have decided to hold it further to get indexation benefit.”

Jimmy Patel, MD & CEO Quantum Mutual Fund believes that transaparancy of debt funds has attracted many investors. “Debt funds are more transparent with the introduction of Potential Risk Class Matrix (PRC).”

Overall, individual investors continue to hold majority of assets in equity funds. The data shows that individual investors contributed Rs.20 lakh crore as on June 2023. Let us look at the table to know more:

Individual Holdings for June2023